Must i explore a loan since a deposit to own a property?

Although the protecting to have in initial deposit perform often be preferable, we realize it isn’t usually you’ll be able to or may take age at best.

Rents during the number highs and you will rising home prices are so it’s increasingly hard for of many aspiring people to save adequate to own an effective significant put.

This past year the common first-big date client put in the united kingdom is an astonishing ?53,935. One shape commonly undoubtedly always rise, so once you have in fact managed to conserve you to definitely count, the new goalposts will provides went.

Simply speaking, yes; it’s possible to use an unsecured loan since in initial deposit to own a house, yet not of several lenders accept which, and you can expect to have wider variety of selection if your loans your put off their supply.

How does playing with a personal bank loan to have a deposit getting a beneficial household work?

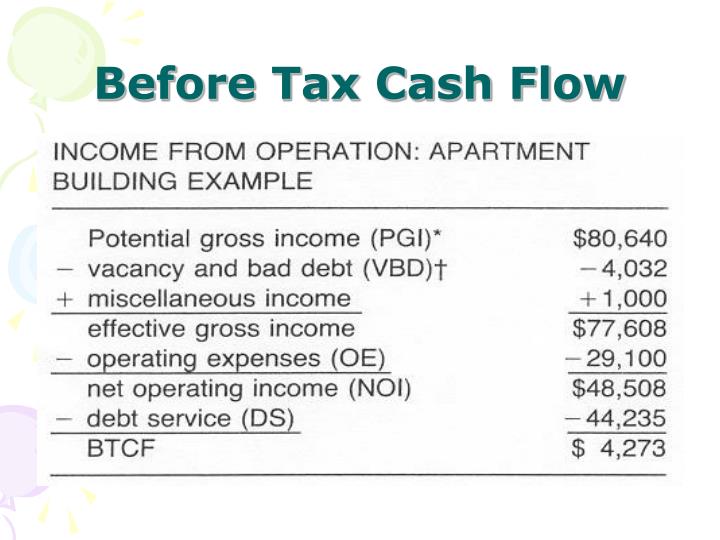

You will need to think about the monthly costs for both financial together with payday loans online Connecticut personal loan, the mortgage supplier will even make up both of these costs whenever determining the affordability.

Before applying for a financial loan, its really worth examining having a large financial company such as for instance Fight about what impression one future mortgage repayments could have in your value. Might including find out if your be eligible for lenders you to definitely believe deposits financed from the unsecured loans. The worst thing you want to do was pull out a mortgage just to realise you can not rating a mortgage.

It’s really worth bringing up that every lenders consider the payment per month of one’s financing rather than the a great balance whenever determining cost.

Personal loans are often available more terms of step one-seven years. While the providing a loan more a smaller name will make sure you spend reduced appeal full, a shorter mortgage identity with increased monthly payment will get a much bigger affect their home loan value as compared to that bequeath more than longer.

Such as for instance, an excellent ?10,000 personal bank loan spread over eight-year label during the 5% could well be ?141 a month compared to the ?three hundred more than three years. This might make an improvement towards amount you could potentially borrow secured on a mortgage.

Really home loan company requirements believe that the private mortgage should be pulled with an alternate business on mortgage vendor. The absolute most you might usually borrow secured on a personal loan try ?twenty five,000, although the count you could potentially borrow hinges on their cost and you may credit score.

Minimal deposit getting a mortgage is 5% of the home worth, nevertheless the deposit required is dependent on new lender’s standards and you may their put. You could use the non-public mortgage to cover some or the of one’s put.

Is using a loan having a deposit a good idea?

So it relies on your own products and also the available options in order to you. Try to assess the complete will set you back of one’s mortgage and mortgage money and you may contrast them to what you are currently investing in the rent and you may rescuing having a deposit.

Instance, in case the lease try ?1,000 monthly and you’re preserving ?3 hundred thirty days getting a deposit, your complete prices was ?1,3 hundred per month. Let`s say the loan is ?900 while the financing ?250 four weeks, you would be ?150 monthly best off monthly.

The full will cost you compare commonly needless to say, trust your put peak, home loan term, rates of interest and you will most recent quantity of outgoings.

Even if the can cost you of financial & loan is higher than your outgoings, you may still determine to acquire ‘s the proper choice since you tend to own a home and stay chipping aside at the very own home loan in place of investing their landlord’s home loan away from.