Mortgage loan Guide

Since you take care to examine an educated mortgage http://www.clickcashadvance.com/personal-loans-nd/columbus brokers, its wise to know doing you could about the software procedure, the many lenders, as well as your some loan selection. Keep reading more resources for financial services the way they really works.

How can Mortgage loans Work?

Whenever customers remove home financing, it borrow a specific amount of currency and you will invest in spend it straight back over time. Generally speaking, buyers need to have a down-payment to buy property, and they’re going to feel charged mortgage loan on their home loan that’s based on an annual percentage rate (APR).

The loan financing is backed by the fresh security at home these include to get, thus borrowers is also reduce their residence in order to foreclosures whenever they falter to keep track the monthly installments. That being said, residents along with create guarantee within homes as they make repayments throughout the years, and they’re going to very own their house downright while the finally financial commission is generated.

Mortgages are in a variety of models and might are fixed-price mortgage loans, adjustable-rates mortgage loans, and other mortgage brokers targeted to veterans and basic-big date homeowners.

Style of Mortgages

- Traditional Home loans: Old-fashioned mortgage brokers would be the most frequent particular financial, and are also aimed toward consumers that have good credit and you may a good down-payment of at least step three%.

- Fixed-Rates Mortgage loans: Fixed-rate mortgages give consumers a fixed interest rate, repaired payment per month (principal and you will notice), and you can a fixed cost schedule that usually persists fifteen to 29 many years.

- Adjustable-Price Mortgages (ARM): Fingers try 31-seasons lenders that come with rates that will alter which have ple, you have to pay a competitive repaired interest with the very first four decades, with mortgage you to adjusts that have market standards.

- FHA Loans: Government Housing Government mortgage brokers let consumers rating home financing having easy borrowing from the bank official certification, lowest settlement costs, and you can a down-payment as little as 3.5%.

- Virtual assistant Finance: Veteran’s Authority mortgage brokers are only for qualified military participants, as well as include no advance payment criteria, competitive cost, low settlement costs, without need for individual mortgage insurance (PMI).

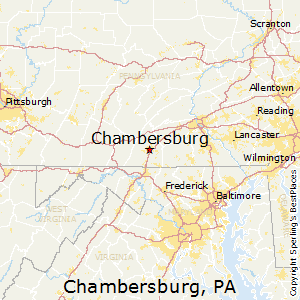

- USDA Financing: Us Department away from Agriculture loans are covered by the Joined Says Service regarding Agriculture, and additionally they let eligible individuals get residential property no money off in particular outlying areas.

- Jumbo Loans: Jumbo fund is mortgages which can be to have highest wide variety than just conforming financing standards near you. In most parts of the country, the brand new 2024 conforming loan limitsare lay during the $766,550 for 1-equipment features.

Ideas on how to Submit an application for home financing

Whether you are to acquire property otherwise wishing to refinance a home loan you already have, you will find some tips required to proceed through the procedure. After you look at the credit score and you will prove you should buy accepted to possess a mortgage, stick to the procedures below to utilize.

- Step 1: Search Mortgage loans to get the Correct Sorts of. Step one in the act was learning the sort regarding financial need, as well as which type you might be eligible for. While you can research on your own, talking-to a mortgage specialist to ascertain which kind of mortgage is actually appropriate your circumstances might help.

- 2: Evaluate Numerous Lenders. After you opt for the kind of home loan you would like, you ought to make sure to compare numerous financial businesses and you may bank offers. Not only in the event that you read over user reviews and reviews, however you should contrast lenders predicated on their stated interest cost and you will financing charges.