The analysis will bring Porter’s five pushes study knowing this new perception of various issues, eg negotiating fuel away from providers, aggressive intensity of opposition, danger of the latest entrants, chance of alternatives, and you will bargaining strength regarding consumers, with the loan brokers globe.

, Flagstar Lender, Entertaining Agents LLC, JPMorgan Pursue & Co., LendingTree, LLC, loanDepot, LLC, LaGray Money, Macquarie Group Limited, Home loan Solutions Pty Limited, PennyMac Financing Properties, LLC, Rocket Financial, LLC. , The PNC Financial Qualities Class, Inc, Wells Fargo, Moneypark, and you can Hypomo. These users enjoys followed individuals strategies to enhance their sector penetration and you may bolster its standing regarding the financing brokers business forecast.

COVID-19 pandemic had a negative affect the loan brokers field while the plethora of some body incurred grand loss because of closure out of company, so there is actually a decrease in level of loans pulled by the customers. Additionally, numerous customers delay its intends to collect financing, car and truck loans while others. It was majorly because of lack of fund into the customers. Ergo, the services of that loan representative in addition to faster in pandemic. Thus, they certainly were the top style regarding financing broker industry pertaining into COVID-19 pandemic.

More over, the client are going to be informal about having the finest financing of the hiring a funds agents

Loan brokers conserves lots of time and you can efforts of your own borrowers for the finding the right lenders that offer a far greater rate of interest into fund. Given that financing agents has actually a routine contact with the lenders they discover the best financial and save time of the customers. Also, they even care for most of the files connected with this new mortgage. As well, the shoppers do not need to worry about all of the legislative work associated with the loan and that’s effortlessly taken care of the agent. Thus, this will be one of the main operating factor of financing agents field.

Financing agents often offer their services in return of a payment or a commission. So it fee is sometimes quite high according to https://cashadvanceamerica.net/loans/single-payment-loans/ the subscribers and this cannot be afforded because of the all of them. Furthermore, often these profits will be large depending on the sort of financing the consumer desires. For this reason, the times members desire avoid funds agents while the from the highest charge it fees and choose to locate a great financing themselves. Therefore, it is a primary restricting grounds into the loan agents market.

This new declaration has this new users out-of trick players doing work regarding the loan agents erica Agency, Caliber Mortgage brokers, Inc

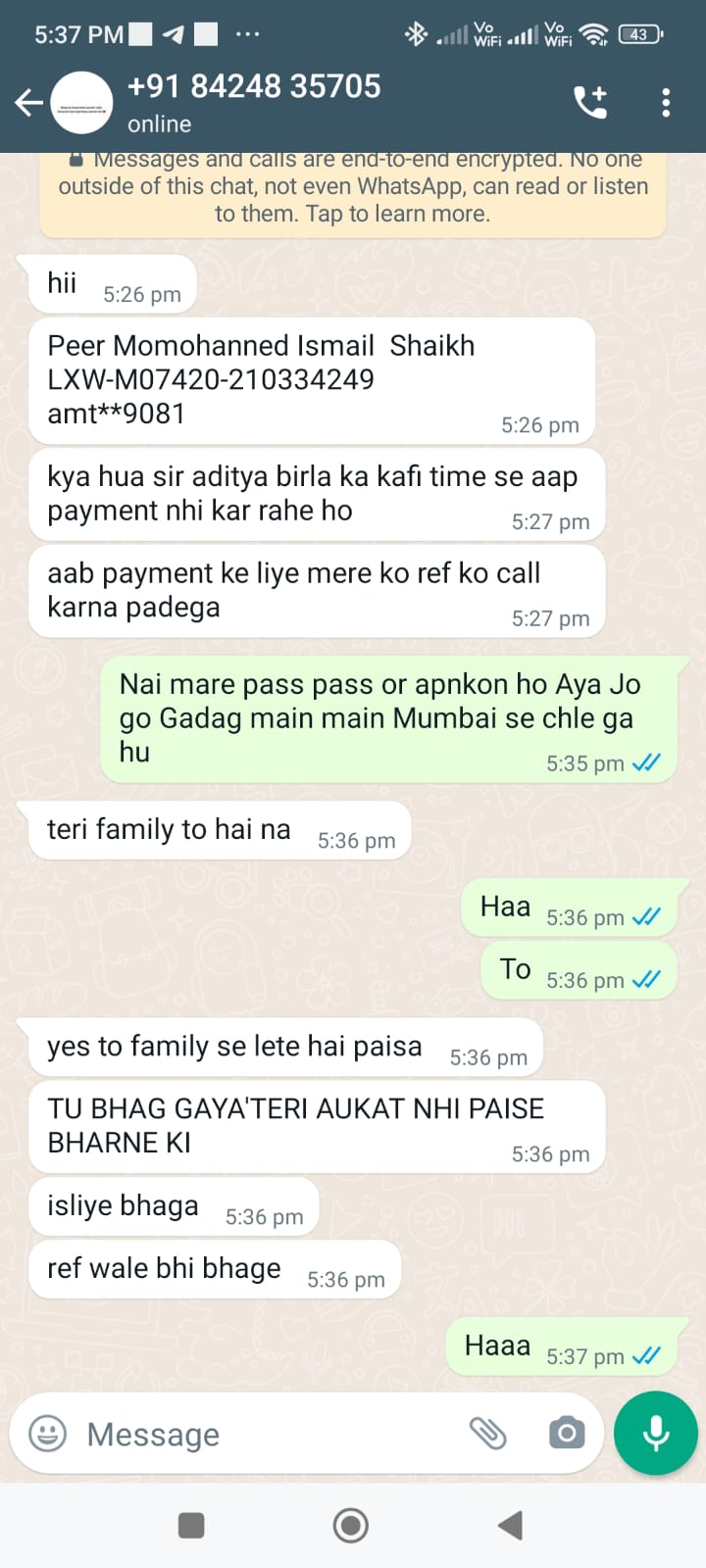

There are numerous instances of scam of the financing agents to their clients. Numerous agents costs money from their customers and you may swindle all of them by disconnecting its calls and you will making the city. Moreover, you will find brokers you to definitely fees currency but never provide characteristics perfectly by the them. For this reason, all the times users forget of employing a brokerage due to the fact of your high possibility of fraud. And therefore, hiring an agent who’s trustable is preferred towards consumer. Thus, that is a primary grounds hampering the borrowed funds agents sector growth.

There was a rising demand for different kinds of loans of the customers eg lenders, unsecured loans, car and truck loans and others. At exactly the same time, people require an informed product sales within these funds towards reasonable you are able to attention. For this reason, the demand for agents keeps growing in the business. Additionally, into ascending significance of fund, the new demand for agents will also raise. For this reason, these types of points can give significant profitable potential for the development of mortgage brokers market throughout the upcoming years.