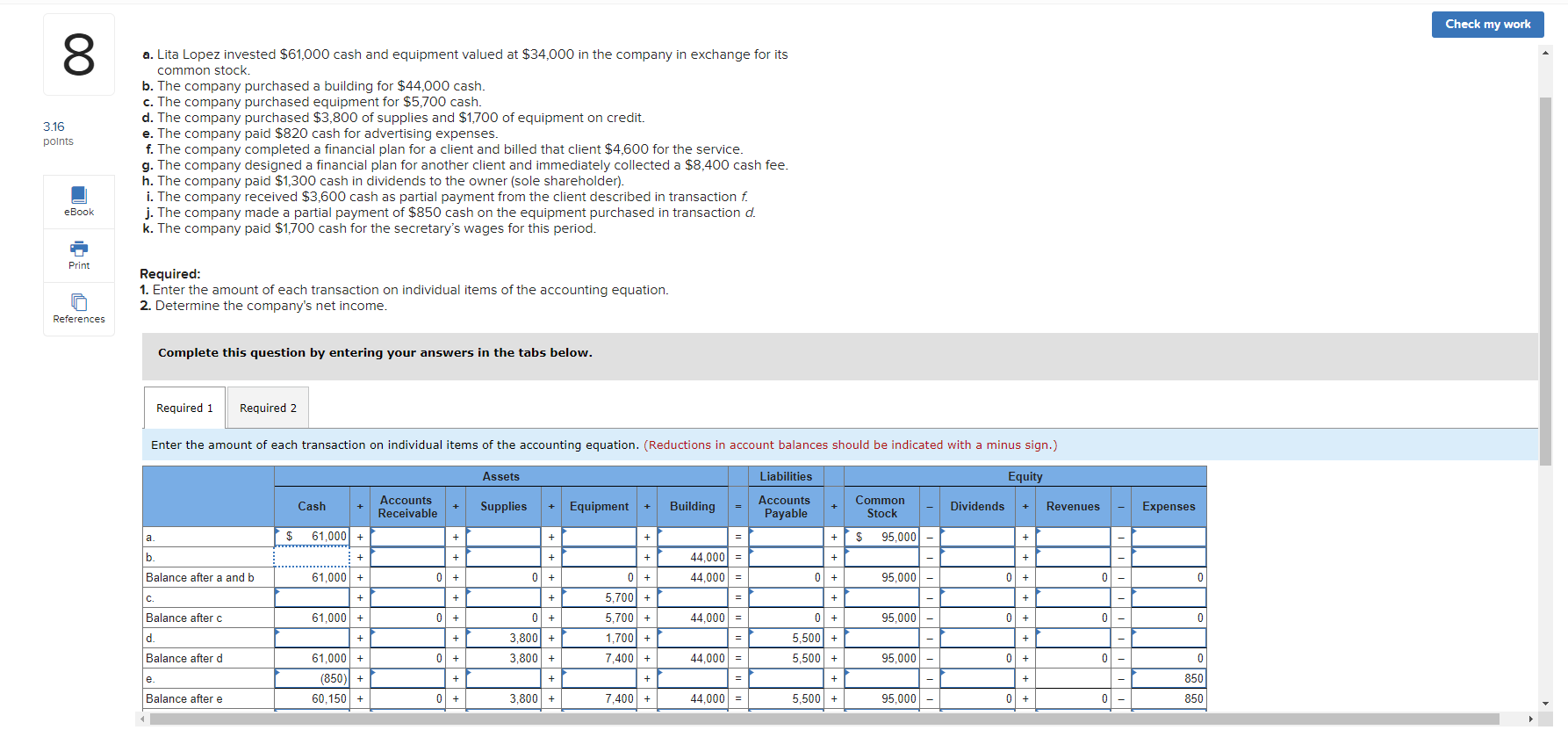

One of current homebuyers, nearly you to definitely-one-fourth of all of the home buyers, and 37% out of first-day consumers, have education loan obligations, which have a typical amount of $29,000. More troubling, 61% away from low-homeowning millennials asserted that student loan debt is actually postponing their ability to invest in a home. Centered on a recent NAR study from student loan personal debt, 51% of the many student loan proprietors say its debt delayed them off to purchase a home. Thirty-half a dozen percent of student loan debt holders state student loan personal debt defer the ily member’s household, a percentage that goes up in order to 52% certainly one of Black financial obligation proprietors.

To address this new expanding debt burden, NAR helps a great multipronged method. Monetary education are extended to greatly help college students as they deal with choices on the investment the degree, when you are assistance programs should be simplified. Just in case you keep debt, opportunities to consolidate and you may refinance obligations in the straight down rates manage assist loans holders all the way down monthly obligations costs, generate higher instructions, and come up with smart lives alternatives. In the end, NAR prefers expanding taxation preferences having businesses who assist group that have its college student loans together with tax forgiveness having loans proprietors who’ve its personal debt forgiven otherwise repaid by its company.

What is the simple issue?

Look will continue to imply that new proceeded rise in college student obligations together with a failure work industry provides an extended-identity impact on the art of very first-date homebuyers, such as low income people, to help you qualify for mortgages. Most of these prospective consumers look for a serious portion of the total month-to-month debt is constructed of education loan costs. Concurrently, discounted point property offered to purchase is located at historical downs and this after that rate away potential buyers which have student loan financial obligation since the home values still rise. Whenever you are the majority of the study and concentrate has been with the effect so you can Millennial individuals, the latest research is appearing one to education loan loans burdens borrowers out of all the generations, together with Baby boomers and you will Age bracket-X customers that happen to be shouldering the extra weight of your scholar loans because of their children or her immediately after to school article-recession.

NAR research indicates that scholar debt negatively affects the skill of potential home purchasers to save to possess otherwise meet deposit criteria. College student loans is also with an impact on possible homebuyers’ ability in order to be eligible for a home on account of large loans-to-income profile. These products have limited their entry to reasonable mortgage options requisite to purchase a house. Whether or not a massive most of individuals was indeed in charge and diligent to make the education loan costs, their capability to store to own priorities including crisis coupons, medical expenses, and you may off money are particularly more challenging and you may impact the conclusion instance to get a house.

NAR Plan:

NAR strongly supports plan proposals to allow student loan consumers so you’re able to refinance with the straight down rates of interest and streamline loan apps. Simultaneously, NAR aids coverage proposals you to provide education loan simplification, understanding and you will studies. Further, NAR helps procedures that give income tax relief to scholar personal debt holders, and to companies which always assistance to its employees’ education loan personal debt burdens. Likewise, NAR aids procedures that give tax save to people individuals with forgiven student personal debt. NAR and additionally will make sure home loan underwriting advice about scholar financing loans is actually standard and don’t affect homeownership.

Legislative/Regulatory Reputation/Mindset

During the last Congressional training, lawmakers in both people advised changes into education loan program to handle the enormous a fantastic financial obligation.

Democrats backed steps who would cap the burden towards borrowers. Republicans debated that college students earn significantly more than simply low-students and should have the ability to pay-off the money. Although not, Republicans was indeed willing to make clear the government financing program and so they advocate providing borrowers far more clarity concerning the personal debt in addition to their feature to spend they straight back. And, some Members of Congress appeared loans in Collinsville seeking tax change to greatly help people paying off student loans.

The brand new CARES Operate, enacted for the pandemic, allows businesses to invest around $5,250 towards figuratively speaking for professionals due to the fact personnel would not owe You.S. federal taxes to your costs. This plan might have been prolonged so you can 2025. If you’re simply take-up of the plan has been sluggish to start, the fresh new extra may become more attractive in order to companies while they was to draw skill in the present, disruptive job market.

This new Adminstration and you can relevant providers still make changes for the Public-service Loan Forgiveness system and this relieves federal college loans having those people providing at low-payouts or even in public service. After that reforms and you will alter to this program and other government loan applications are now being done now which have rules alter are revealed early in 2022.

In reaction on the COVID-19 pandemic, the newest Department off Education have paused government student loan costs, into current stop longer because of . Future pauses try impractical although is analyzed while the benefit recovers.

The new Biden Government will continue to view their alternatives for college student debt rescue. The newest progressive take off of Democratic class is actually driving for most particular college student loans cancelation, with many calling for all the college student obligations become treated and you will anyone else mode a cap. The new Administration for the moment has been unwilling to make any large change other than alter in order to newest loan software.