As a premier step 1% Founder in the united states, Joel is actually a trusted Dallas home loan company. He understands the need for receptive and you may knowledgeable solution, particularly in a quickly expanding region urban area such as for example Dallas-Fort Worthy of. The newest previous You Census Bureau declaration has actually Fort Worthy of ranked because the fastest-increasing urban area in the us. And Site Solutions Category provides the Dallas Metroplex given that 5th fastest-broadening location city in the united states by the 2028!

Relocations continue to keep pouring in, which is ultimately causing a low way to obtain homes for sale. This is why, home prices was upwards. If you are a primary-date homebuyer, this particular fact may seem challenging. not, whenever you can pick a house, you should always pick property. Joel Richardson has arrived to help you get a home loan order your dream household now.

Mortgage Credit Made Problem-100 % free for Home owners during the Dallas, Colorado

If or not you purchase a house for the first time or was a properly-trained homebuyer, you have to know that to shop for a home is actually thrilling and you may fulfilling. Within the Dallas and you can Fort Value, there are lots of mortgage selection which you can use based your situation.

Conventional, Repaired Speed Mortgage

The pace doesn’t transform in the life of the fresh mortgage. For some homebuyers, minimal down payment is actually 3%.

Government Casing Government

A government-covered home loan for those https://clickcashadvance.com/personal-loans-tx/richmond/ that have limited income or bucks to possess a down payment. FHA finance supply repaired rates and you can minimal down-payment try step three.5%.

Experts Products Financial

Professionals previous and effective armed forces group and their families. Va finance are fixed rates loans and supply $0 down payment possibilities.

Case Loan

Changeable price financial or Case where in actuality the payment per month is fixed for many decades and often to alter following repaired price several months. Lowest down payment is actually 5%.

USDA Financial

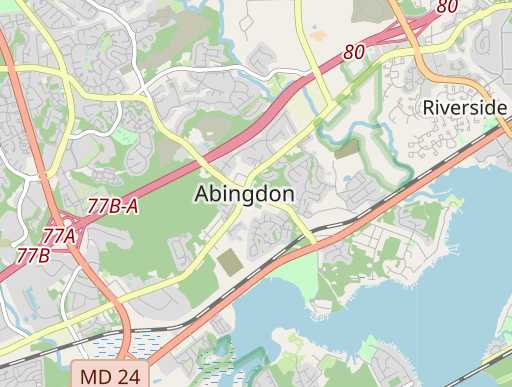

Us Agencies away from Agriculture (USDA) mortgage, coincidentally an authorities-supported financing for people who live in quicker urban centers and you will towns. USDA also provides $0 advance payment but is income restricted.

JUMBO Financing

Also known as nonconforming loans while the amount borrowed try large than the controlled limitations for old-fashioned funds. Anticipate ten% down at least while the ideal costs require 20% down. One another fixed and you will adjustable price loans are offered for jumbo issues.

Dallas Mortgage brokers Produced Troubles-100 % free

You are interested in a mortgage credit option when you look at the Dallas due to the fact you prefer help to invest in a property. Meanwhile, need the method becoming just like the hassle-100 % free that one may. The lending company will be some body your trust. We know resource your dream is a significant price, so you should find the correct lending company in Dallas, Tx. Thank goodness, you have got come to the right spot. Joel Richardson and VeraBank people was here to ensure your feel safe for the techniques.

We understand one to interest rates enjoys a significant impact on your choice. At the same time, we make certain the procedure is simple, timely, and worth your time. Information about how it really works:

The initial step

Start by the program techniques. It isn’t difficult! Your use online and it takes only a short while. New series of simple-to-discover concerns tend to head your with each other. You might prefer a price and can along with go after the newest down-payment. After pre-being qualified, we’ll make you a loan estimate.

Second step

Out-of my site, you might upload records we require to help you qualify your. You will need to fill in extremely important files ahead of i proceed for the buy to make a beneficial prequalification page.

Step three

As soon as we can also be point the fresh prequalification, you’re on our home search! The agent will demand this new prequalification* letter presenting a deal into the supplier. We functions hand-in-hands with your agent presenting your own promote on provider. (*A good prequalification isnt an affirmation of borrowing from the bank, and will not signify you to underwriting conditions had been satisfied. )