What is a fixed Rate of interest?

A predetermined interest rate are a keen unchanging rates billed with the a responsibility, such that loan or a home loan. It could pertain when you look at the whole label of your financing or just for part of the identity, it remains the same throughout the a-flat months. Mortgage loans may have several notice-speed choices, as well as one that integrates a predetermined rate for the majority part of the phrase and a changeable speed into balance. Talking about named hybrids.

Secret Takeaways

- A predetermined interest avoids the danger one to home financing or financing percentage is significantly improve over the years.

- Repaired interest levels shall be higher than changeable pricing.

- Individuals will pick fixed-rates loans throughout the periods of low interest.

Just how Repaired Interest rates Work

A fixed rate of interest wil attract so you can individuals that simply don’t need their interest pricing changing over the term of the money, probably growing their attention costs and you may, by extension, the home loan repayments. This type of rates prevents the danger that comes with good floating or adjustable interest rate, where price payable towards the an obligations duty can vary according to a standard interest otherwise directory, either all of a sudden.

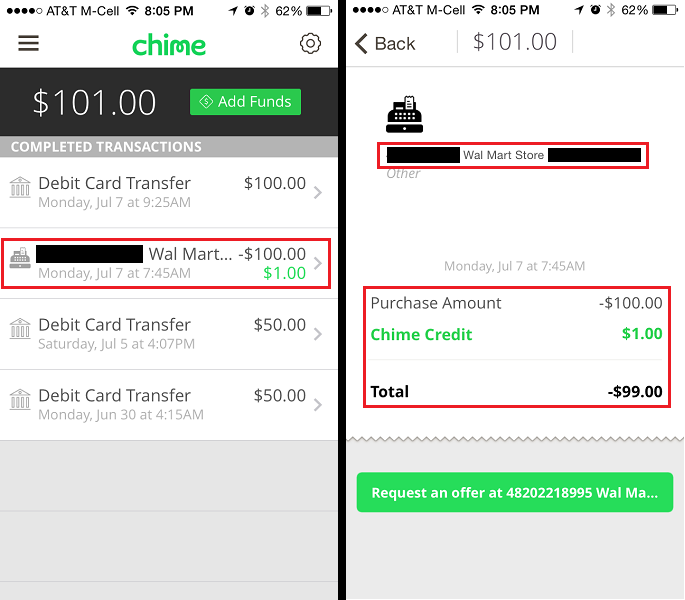

Individuals will opt for fixed rates whenever the interest rate personal loans for bad credit Nevada ecosystem is actually reduced when securing about price is very of good use. The opportunity cost is still way less than simply while in the episodes regarding large rates of interest if interest rates finish going down.

Fixed pricing are generally greater than varying pricing. Funds which have varying otherwise variable costs constantly provide down introductory or intro pricing than just repaired-rates fund, and work out these money more desirable than just fixed-speed loans whenever rates are large.

The consumer Monetary Safety Bureau (CFPB) provides various interest rates individuals can expect at any provided date depending on their venue. The fresh costs was updated biweekly, and consumers can enter in recommendations eg their credit rating, downpayment, and loan types of to locate a closer idea of what repaired interest they could shell out at any given time and you can weighing that it up against a variable-price mortgage (ARM).

The pace toward a predetermined-price financing continues to be the exact same in the life of the mortgage. Given that borrower’s payments stay an identical, it is easier to budget for tomorrow.

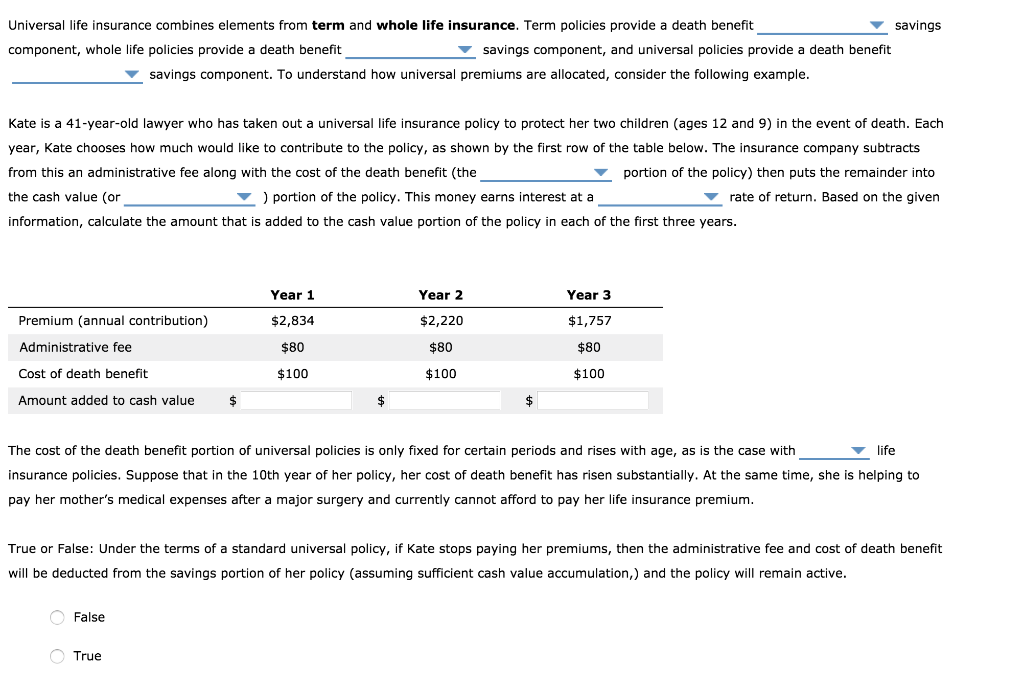

How to Assess Repaired Focus Can cost you

- The borrowed funds matter

- The interest rate

- The mortgage installment period

Understand that your own fico scores and you may earnings can also be influence brand new cost you have to pay having financing, regardless of whether you choose a fixed- otherwise variable-rates choice.

On the web financing hand calculators helps you easily and quickly assess fixed rate of interest prices for personal loans, mortgage loans, or other personal lines of credit.

Repaired against. Changeable Rates

Varying interest rates on Possession alter from time to time. A borrower normally receives a basic rate to have an appartment period of time-tend to for just one, about three, or 5 years. The speed changes into an intermittent foundation up coming part. Like changes cannot exists with a fixed-speed loan that’s not designated given that a crossbreed.

In our analogy, a lender offers a borrower a step 3.5% introductory price with the a beneficial $300,000, 30-12 months financial with a 5/step 1 hybrid Sleeve. Their monthly installments was $1,347 inside first 5 years of the mortgage, but people money increases or decrease in the event that rates changes according to the interest rate lay by the Federal Set aside otherwise another type of benchmark directory.

If for example the rate changes so you’re able to six%, the fresh borrower’s monthly payment do increase from the $452 so you can $step one,799, which can be difficult to carry out. Nevertheless monthly installments perform slide so you can $step 1,265 whether your rate decrease to three%.