Credit otherwise Credit ratings vary from three hundred so you can 850. A high count implies down risk. When applying for a mortgage, any score more 740 will be eligible for a reduced you are able to rate into the a particular financing. Next 2 circumstances use 670 towards the reduced FICO get and you will 740 toward highest rating.

The Number

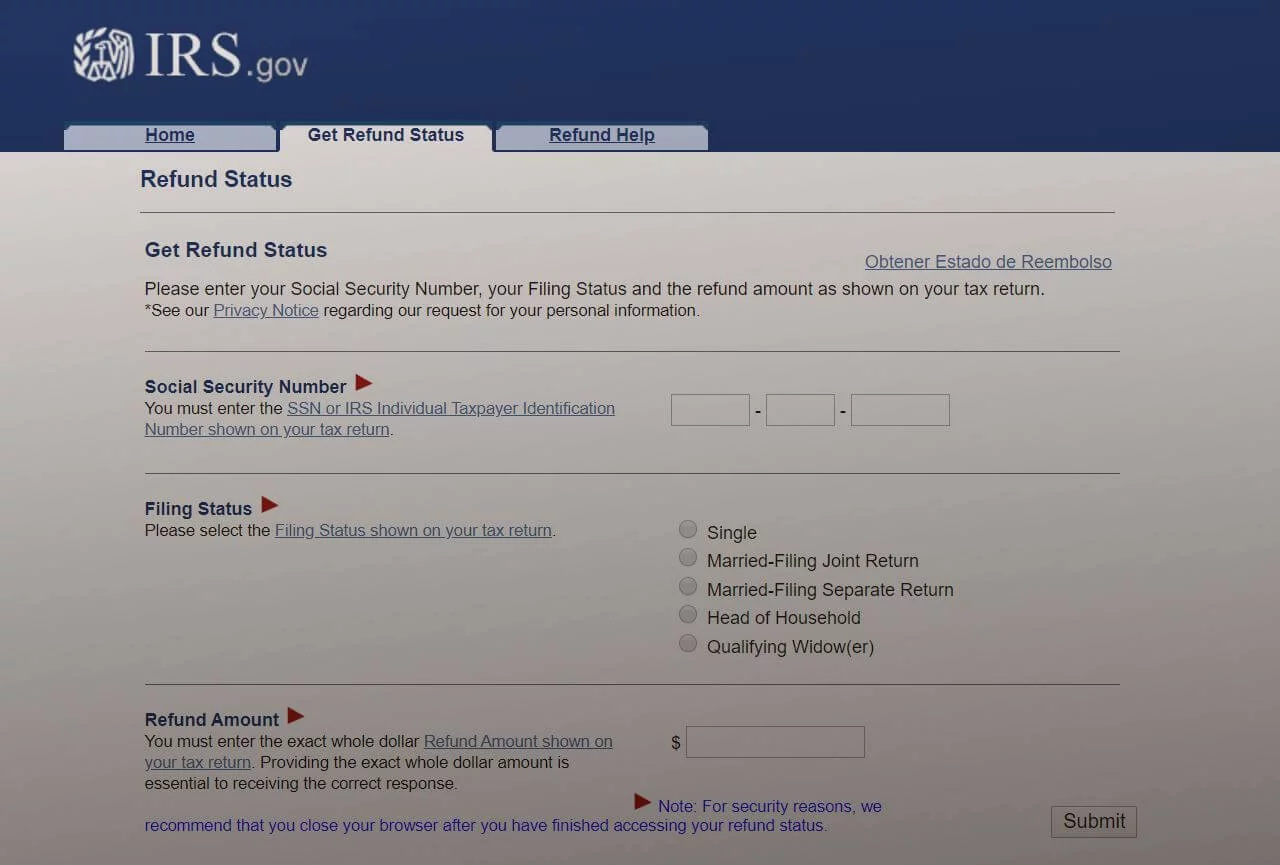

Contained in this scenario, the interest rate to your a 30-seasons repaired speed mortgage on the advanced level buyer (740+ FICO get) was 5.000% (5.173% APR) that have a monthly payment away from $dos,494 (excluding taxes & insurance). The customer with fair/a good credit score (670 FICO score) on a single style of mortgage is eligible to possess a rate out of 6.500% (7.016% APR) which have a payment per month out of $3,103. You to definitely fee was $609 alot more monthly, totaling $7,308 each 12 months the consumer is actually that loan. Not just ‘s the straight down FICO score expenses alot more inside the attention (6.5% versus 5.0%), they’re also paying far more privately Financial Insurance ($259/mo vs $79/mo). Individual Home loan Insurance policies (PMI) is required because of the really lenders whenever putting less than 20% deposit. See the chart below to own a breakdown of the fresh fee differences.

Your skill

You can observe much improving your borrowing from the bank can help to save when selecting property. It’s going to help save you towards other credit lines along with credit cards and you may auto loans. It can also perception your property and you may car insurance prices. But what might you do in order to improve your credit score having today.

Listed below are 5 ideas to assist raise your credit score:

- Create your money promptly. Here is the foremost topic. They makes up about thirty five% of the score.

- It is okay to utilize handmade cards but holding a top balance (balance more 29% of your limit, and especially alongside your limit borrowing limit) may have a terrible affect your own score. The degree of borrowing from the bank you use try 30% of one’s get. E5 Mortgage brokers has products to check on your own credit lines and determine how far your own rating can be improve if you are paying down the equilibrium to your particular cards instead of someone else.

- Did i mention making your repayments timely? Specifically, you shouldn’t be late to have a rent otherwise mortgage repayment. Most loan providers bring an effective fifteen-date grace period without penalty. Once 15-days, you will end up believed late that can feel charged a late commission. Shortly after 29-days, youre thought late and can improve negative feeling to help you your credit rating.

- If you don’t have one handmade cards, it could be really worth acquiring one. Just build a fee and you may pay it off at the bottom of your own times. Which demonstrates your ability to pay on time. (select #step one and you will #3)

- Be mindful of how many levels. When you have loads of loans Leroy AL credit cards, it’s not necessary to intimate them. Carrying a zero equilibrium cannot hurt, and have a mixture of offered borrowing helps. Yet not, asking on the and you may starting a lot of the fresh new traces is damage credit scores in the short term.

The final word of advice will be to speak with E5 Home Funds in advance of in search of an alternative household otherwise refinancing. Not only will one of the knowledgeable loan officers advice about an excellent prequalification and you will a speed price, they may be able and additionally show specific solutions to change your personal borrowing from the bank situation.

For those who have any queries on the reviewing your own borrowing from the bank or was interested observe what you could be considered in order to use, get in touch with E5 Lenders. Even though you curently have a bid or prequalification, contact you for a second View. E5 Home loans storage to discover the best things around the of a lot loan providers therefore we usually do not charges a bunch of in love charge.