Double-look for and you will erase people aside-of-day beneficiaries in your company-paid term life insurance and you may 401(k) package, particularly if you was indeed solitary after you come your work. “While there is a major lifestyle changes, you need to examine men and women beneficiary statements,” says Dee Lee, a certified economic coordinator which have Harvard Financial Teachers. Your mother and father, siblings, if you don’t a previous partner might still end up being noted instead of your youngster.

Third Day

It few days, you should check your credit rating and use all that spending suggestions you have been meeting to create a proper funds.

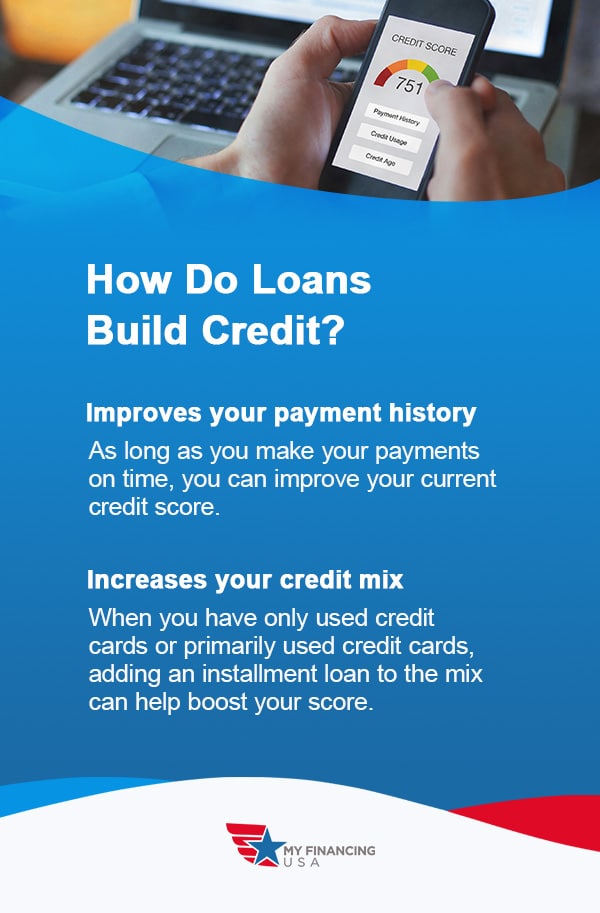

Check up on your credit.

Save your time and problems from the repairing errors now, if for example the life is relatively sane. Which have an effective credit score is essential while a parent-to-end up being and you may probably exploring large commands particularly a house or a car or truck in the near future. With a leading credit history makes it possible to protected the newest best interest rates on a car loan or home loan.

You could to buy your credit report out of Equifax, Experian, or Transunion. Legally, they may charges only about $twelve to possess a simple report. End up being forewarned you to definitely applying for a free credit check of smaller reliable company are going to be an invitation so you can identity theft & fraud. At exactly the same time, limitation you to ultimately singular examine a-year-any further than just that hurt your rating.