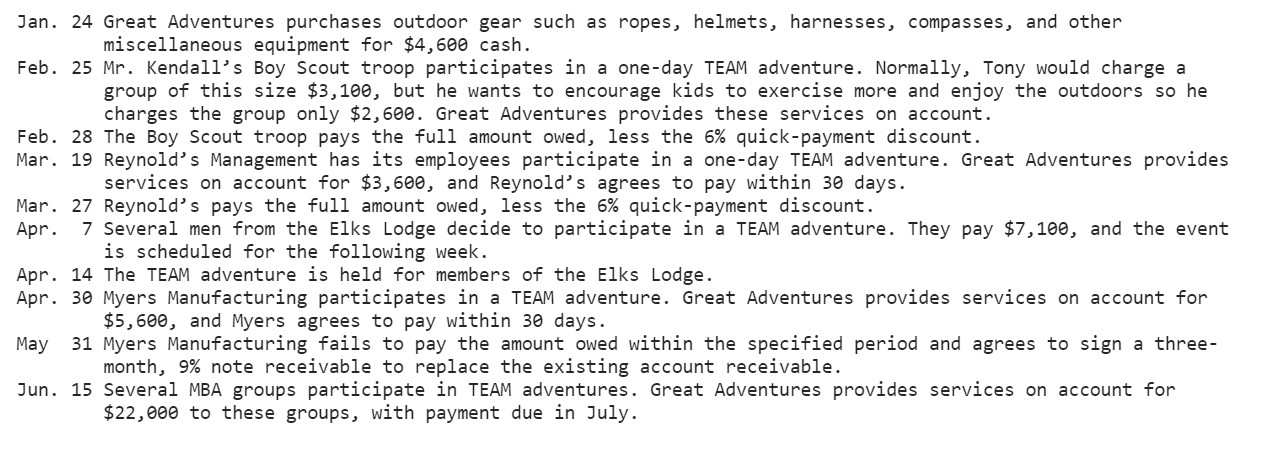

According to the typical of all almost every other banking institutions, First Republic got a good proclivity to help you run sizzling hot which have normal mortgage-to-put percentages in the large 80’s to more than 100%. This really is an aggressive approach to credit that tries to optimize yield when you are compromising liquidity. The willful decision to perform at this high loan-to-deposit ratio happier buyers with high production to your assets however, did not leave far area to own mistake. Because Buffet has said, In the event that tide goes out, we see that is diving undressed. Which is exactly what i watched when the illiquidity of the financing profile is along side historical distributions out of places.

Powering on exits

If interest nature hikes had drawn complete feeling by end of 2022, of several consumers and you may bank dealers became smart to the new facts which had been haunting financial balance sheets. Longer-cycle possessions particularly >30-day Valuable Bonds and you may Mortgages which have been originated in a greatly lower rate of interest ecosystem, subjected banking institutions to high liquidity threats because of a good mismatch for the new readiness of your possessions (ties, mortgages) and debts (deposits). All these finance companies was indeed mainly financed because of the request dumps, money-markets and you may quick-name Dvds. In order to exacerbate the trouble, 68% off Very first Republic’s complete deposits was basically not in the $250,000 number of FDIC deposit insurance rates.