Optimize your Credit score

Enhancing your credit score is essential to own protecting a favorable domestic collateral mortgage. To improve your own creditworthiness, start by using expenses on time to exhibit in control economic choices.

Keep bank card balance reasonable and avoid starting several the fresh new accounts, because these strategies can negatively perception their rating. Daily check your credit report to have problems and you will argument any inaccuracies punctually.

Try to care for a cards application proportion lower than 29% to show sensible borrowing management. Simultaneously, refrain from closing old membership, while they lead absolutely into borrowing history’s duration.

Decrease your Obligations Very first

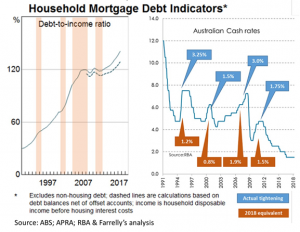

Imagine reducing your present financial obligation before you apply to have a house guarantee mortgage to switch your financial status and increase your chances of approval. Lenders prefer borrowers with all the way down obligations-to-money percentages, so it’s necessary to reduce a fantastic balances into handmade cards, funds, and other debts.

From the coming down the debt, your have indicated monetary responsibility and relieve the risk getting loan providers, possibly resulting in a lot more good loan words. Prioritize paying down high-notice expenses earliest so you’re able to free up more income for your home guarantee mortgage costs.

Household Equity Loan compared to. HELOC

Domestic equity financing and you will a house security line of credit (HELOC) are a couple of different ways out-of credit money contrary to the value of your house. However, the fresh new similarities inside their labels commonly make people utilize the words interchangeably. When you yourself have a future debts you decide to fool around with house collateral to pay for, you need to know the difference anywhere between these terminology.

Read moreOught i Use a property Collateral Loan to own Resource Characteristics?