Exactly how Education loan Financial obligation Has an effect on Your own Qualification to have a mortgage

It’s possible to locate home financing while you are holding pupil loan personal debt, so long as you nonetheless meet with the lender’s requirements. But not, having student loan personal debt can make purchasing property more difficult, as the lenders will feedback your debts, and exactly how your debt comes even close to your earnings, to be sure you might pay back the loan.

Secret Takeaways

- Student loan personal debt has an effect on the debt-to-income (DTI) proportion, hence loan providers used to see you due to the fact a borrower.

- The more personal debt you have, the low your credit score, and loan providers use your credit history to evaluate risk.

- Some types of lenders possess lower DTI requirements and lower down-payment conditions.

Carrying student loan personal debt basically renders being qualified getting home financing harder for several reasons. Very first, student loan financial obligation expands your debt-to-earnings (DTI) ratio, and that loan providers used to assess your own exposure since the a borrower.

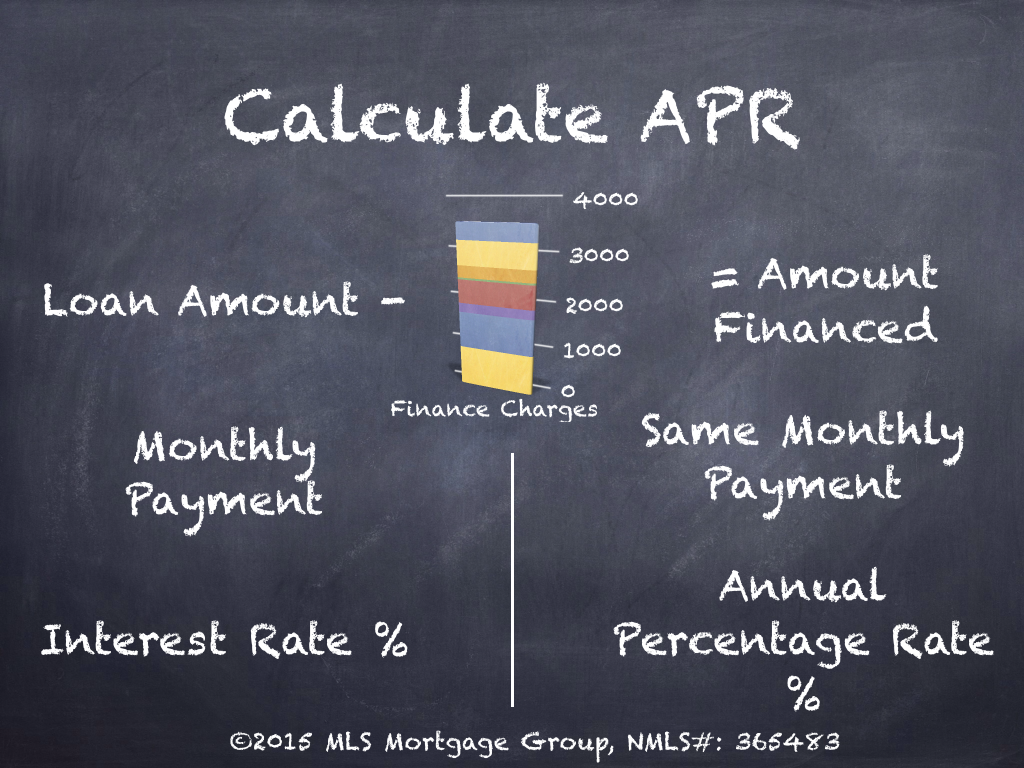

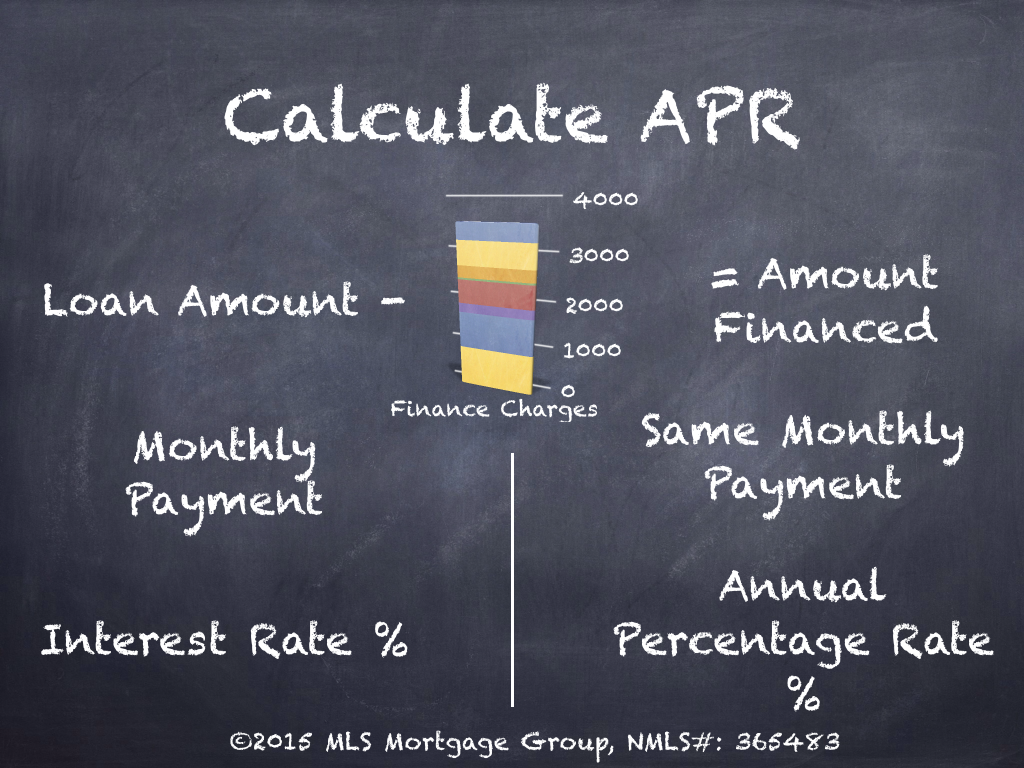

The DTI is basically brand new ratio away from loans repayments you have monthly versus their monthly earnings. Many lenders wanted DTI rates which might be thirty six% otherwise shorter, but some lenders has highest maximums. The higher your DTI ratio, the greater hard it could be discover acknowledged for a good mortgage.

Your credit rating is dependent installment loans Massachusetts on several facts, as well as your commission history, borrowing usage ratio, borrowing from the bank merge, the level of the latest credit you’ve recently removed, plus the amount of your credit history. Dealing with into-day repayments in your education loan personal debt for a few decades usually have shown their creditworthiness, that can work for your credit rating.

However, with student obligations may negatively feeling your own score. For-instance, if you’ve ever generated later repayments on your own student loans otherwise skipped payments entirely, your credit score most likely refuted thus.

Read moreExactly how Education loan Financial obligation Has an effect on Your own Qualification to have a mortgage