Special Semiannual Monetary Statement below Control A questionnaire step 1 SA

The financial statements and discussion and https://cashadvanceamerica.net/personal-loans-mi/ analysis of our financial condition, results of operations, and financial statements contained right here within should be read in con found here. This discussion and analysis may contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors.

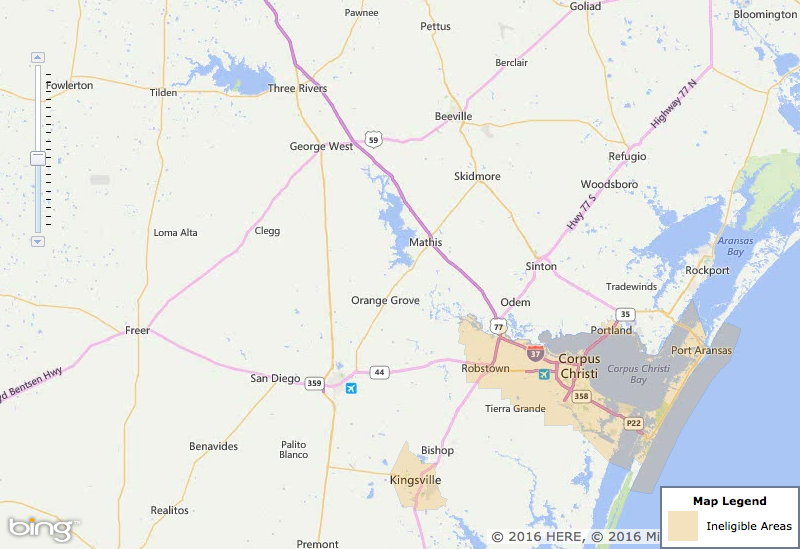

CWS Assets Inc. (the “Business,” “We,” “Our”) are a great Virginia created enterprise molded thereon acquires and manages a house supported finance, and also other a home relevant property, to include single relatives residential property and you can shorter, multi-family relations properties. The firm, commands creating and you can low-carrying out promissory notes, personal lines of credit, and you can property installment agreements secure by the real-estate (“Notes”) about Us which have financing so you can worthy of attributes lower than 100%. Meaning, the business aims on to get Cards that will be fully covered with additional collateral visibility. Due to the fact Organization primarily invests for the very first mortgage loans, the firm may opportunistically buy second mortgages if they fulfill these attributes. The company ily residential property and you can shorter multi-friends land.

The fresh new associated equilibrium sheets, statements regarding functions, shareholders’ shortage and money circulates since and they are unaudited and you may have not been reviewed from the an external auditor

Next Consequence of Functions depend on new unaudited economic comments towards six months finished “), new unaudited monetary statements for the six months ended “), additionally the audited monetary comments as of .

Read moreSpecial Semiannual Monetary Statement below Control A questionnaire step 1 SA