Into a frequent june date my water heat stacks up to help you temperatures within just a few minutes, but it takes my oil 15 minutes or even more to find doing temperatures. And you may, it could be much longer inside the winter. In the event that all you want is a drinking water temp determine therefore begin getting inside it after liquids are upwards so you’re able to heat, you are conquering the system before oils is preparing to include it. My tips guide doesn’t say anything from the water temperatures. Alternatively, it tells hold back until this new oil is 180F or even more ahead of pushing the auto.

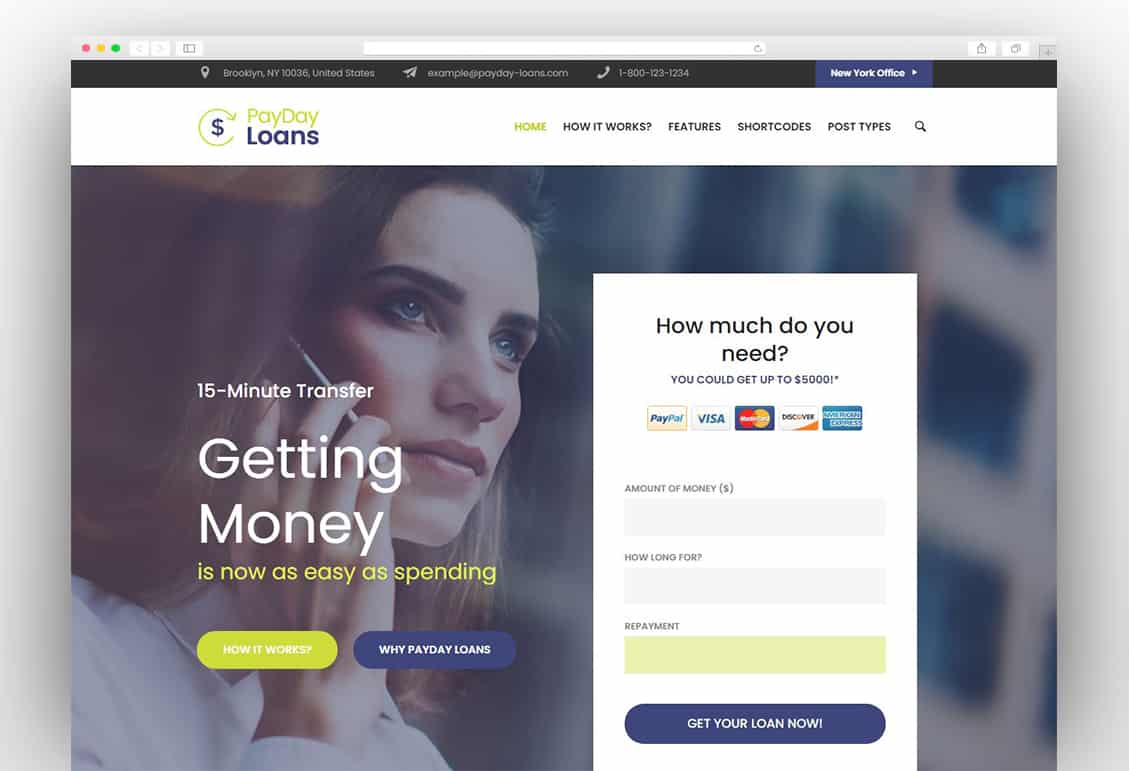

payday loan now bad credit

Simple Mortgage Closure Records and you can a quick Need ones “>>,”slug”:”et_pb_text”>” data-et-multi-view-load-tablet-hidden=”true”>

The fresh Closure Statements

This type of records, known as the Closing Disclosures (CD) , for the visitors and you may vendor (for every has actually their separate Cd), detail the latest accounting active in the closure. Here the buyer will get an enthusiastic itemized list of their charge, in addition to its transformation speed, financing costs, title charges, political charges, notice, homeowner’s insurance coverage, escrow membership birth balance, check fees or other contractual debt totaled and an itemized range of brand new loans they discover, along with its earnest put, mortgage balance, supplier settlement costs concessions, and you will income tax prorations are all totaled and these credit try deducted about terrible number due and you can mirror the amount the consumer will likely then owe. The fresh new Seller’s Closure Revelation really works backwards of your Buyer’s Closure Revelation. It begins with totaling the fresh Seller’s Loans then totaling the brand new Seller’s charges, and subtracts the fees throughout the loans and you may shows the fresh “net” sales proceeds with the Vendor.

The customer gets a great Computer game highlighting merely the bookkeeping but is sold with terms and conditions into Mortgage Program picked plus it perhaps not closed by or identified by the seller, from all of these loan terms and conditions. Owner separately signs good Cd showing simply their accounting.

Pros enjoys stated that $929 million, an archive number of CMBS loans, are ready in order to mature inside 2024

Picking out the bank that fits the requirements of for each and every customer try what we should would finest

While we begin the next one-fourth out of 2024, the new Detroit commercial home loan marketplace is up against some obstacles and pressures.

Borrowers? deals buffers can help them to adjust to higher loan repayments

But not, two to three months after roll-from, the new shipment out of buffers among has just rolling out-of fund stays straight down compared to varying-speed funds; merely to 1 / 2 of protected new arranged fee for a few Oklahoma installment loans or significantly more weeks (weighed against around a couple-thirds away from variable-price and you may broke up loans). This suggests one particular fixed-speed individuals can be deciding to hold its discounts exterior their home loan or, for some reason, that this cohort features fewer offers than all the changeable-rate consumers.

Conclusion

Borrowers with fixed-rate finance provides experienced or often deal with large, discrete grows within financing money when their fixed-price terms expire. Loans which might be but really to roll regarding tend to face the biggest grows, whether or not these types of individuals also have benefited the best from to prevent high loan repayments thus far as well as have got more hours to arrange on the boost in mortgage repayments.

Read moreBorrowers? deals buffers can help them to adjust to higher loan repayments

Toscano, chairman out-of Lovers to possess University Cost and you can Public Believe

The underlying university fees nature hikes was in fact significantly more readable whenever claims have been slashing advanced schooling spending plans after the depression within the 2008, but over the past 5 years condition paying for advanced schooling in reality flower loans Dakota Ridge CO by the 18.step three per cent, otherwise $14 million, states Dr. James P.

If you are total county service has been maybe not up to where it once was – which have you to October research interested in state resource to have personal one or two- and you will five-year universities on the university season finish in the 2018 was more than $7 million lower than their 2008 level – it is an optimistic trend. In addition, students’ express away from university fees, which increased easily after the financial crisis, could possibly get ultimately become grading, with regards to the State Degree Exec Officials Connection.

But the rebounding investing profile haven’t inspired rates back at every university. In many cases, Toscano refers to a kind of amenities arms competition of the universities, that have people footing the balance whether they have to or not.

Toscano lobbied the latest Virginia legislature and claimed a tuition frost to have the fresh new future college seasons, to produce they initially when you look at the 17 age that university fees won’t increase

Everything we haven’t viewed sufficient was corresponding discipline when it comes in order to paying, he states.

Read moreToscano, chairman out-of Lovers to possess University Cost and you can Public Believe

Credit history To have First-time Homebuyers: All you need to Understand

You are concerned about the fresh poor credit score if you are a first and initial time home visitors. This guide can help you through the various types of very first-big date borrower money which means you comprehend the minimal borrowing worthy of to finance your ideal family. You’ll likely enjoys questions about the fresh new procurement process, especially in monetary things, while you are a property buyer the very first time. The financing score having first time home buyers with of a lot arrangements that will promote a person’s dream property! If you’d like to see how much advance payment you may require, otherwise simply how much loan authorization requires.

Read moreCredit history To have First-time Homebuyers: All you need to Understand