Regardless if Tx dollars-away re-finance regulations is actually a tiny different than various other states, they are no more since the rigorous while they used to be.

Providing you keeps decent borrowing and more than 20% home security, you need to be able to refinance the home loan and you can eliminate dollars out from your house. In accordance with higher equity profile nationwide, of numerous Texans commonly without difficulty satisfy those people standards.

- Tx legislation

- Eligibility criteria

- Texas cash-aside process

- Exactly how in the future should i re-finance?

- Choices

- FAQ

https://cashadvanceamerica.net/installment-loans-or/

How come a colorado bucks-out re-finance really works?

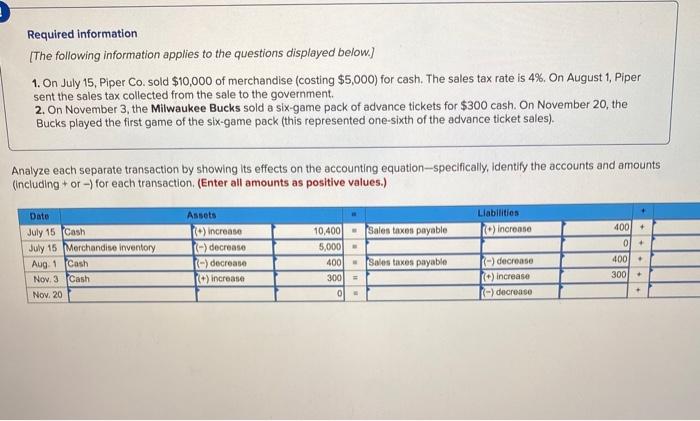

Cash-away refinancing into the Colorado really works a little differently from other claims due to particular laws and regulations and you will guidance put by Colorado local government. I speak about these regulations in detail less than.

A texas dollars-aside refinance is also named a paragraph fifty(a)(6) loan, or simply an enthusiastic Colorado A6 financing. They substitute your current mortgage with a new, larger financing, letting you availableness a fraction of their house’s guarantee just like the bucks.

Colorado bucks-away refinance legislation and you will recommendations

Any citizen is eligible for this Colorado cash-out refinancing loan. You just need to are entitled to more than 20% guarantee of your home, says Plant Ziev, a certified Mortgage Considered Specialist into the Tx.

Eligibility: Texas bucks-aside refinance criteria

So you can qualify for an earnings-aside refinance in Tx, you’ll want to meet certain requirements put by lenders. These Texas re-finance laws are criteria to suit your credit rating, debt-to-money ratio, and you may household equity.

Read moreCash-Out Refinance when you look at the Colorado | Laws & Prepared Months 2025