Checking Account

Find the savings account that really works right for you. Pick our very own Chase Total Examining bring for new people. Go shopping together with your debit cards, and lender of nearly anywhere by the phone, tablet otherwise computers and more than 15,000 ATMs and more than cuatro,700 branches.

Savings Profile & Dvds

It’s never ever too-soon to begin rescuing. Discover a bank account otherwise discover a certificate regarding Put (see interest rates) and begin preserving your money.

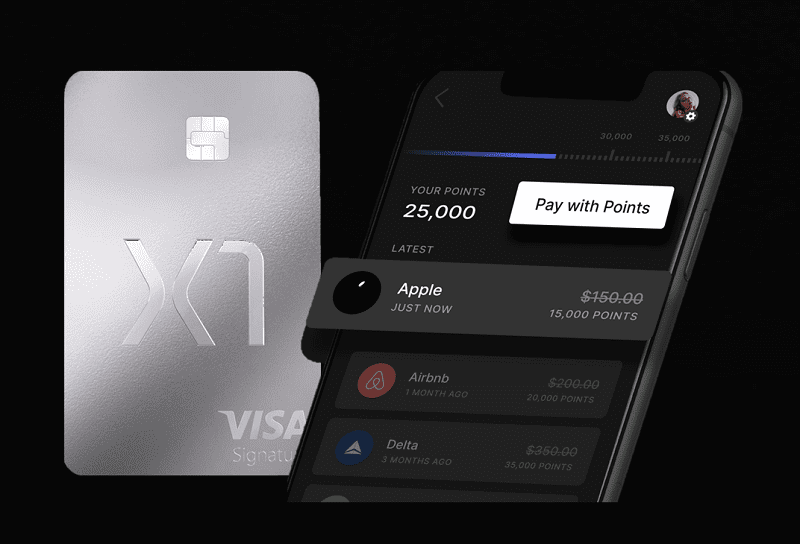

Credit cards

Pursue credit cards makes it possible to choose the exactly what you need. Many of our cards give benefits which might be redeemed having money back or take a trip-relevant perks. Because of so many choice, it could be simple to find a credit which fits your own lifetime.

Read moreWe are here so you’re able to control your currency today and you may tomorrow

.png)