Home values in Bergen Condition, Nj-new jersey rose steadily in the last 24 months. Therefore the speed growth that occurred during 2017 caused government casing officials to raise the latest FHA and you will antique conforming loan limitations for 2018.

Inside Bergen Condition, new FHA and you will compliant limit to possess one-home flower so you can $679,650 to possess 2018. New jumbo mortgage endurance ran right up too. Something that is higher than $679,650 is regarded as an excellent jumbo financial tool.

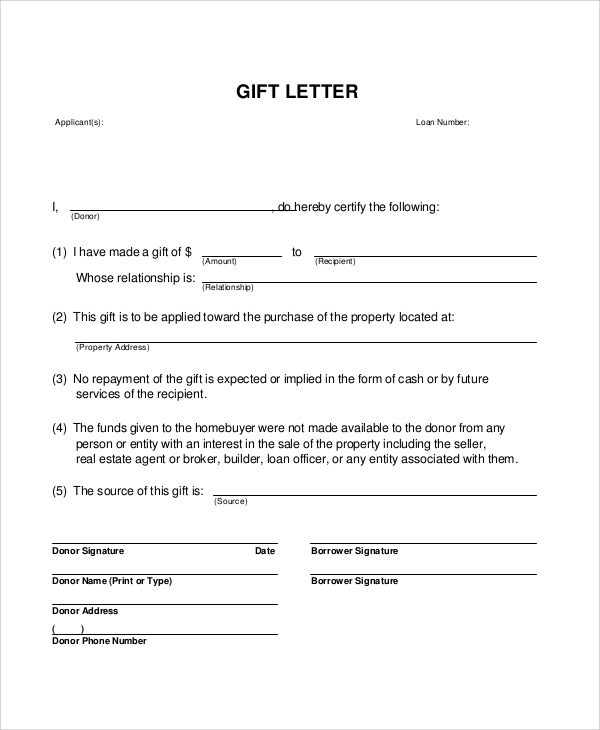

Recap: See Your Mortgage Language

Before i go anymore, we should identify a few of the terminology used here. Understanding this type of conditions is the starting point to help you focusing on how mortgage constraints functions.

- Conventional: A normal mortgage is certainly one that isn’t insured or guaranteed of the federal government. That it establishes it except that FHA and Virtual assistant fund, and that doreceive regulators support. Depending on the matter are borrowed, traditional funds may either getting confotherwiseming otherwise jumbo because outlined less than.

- Conforming: A compliant financing is largely a traditional financial merchandise that fits the size restrictions used by Fannie mae and Freddie Mac computer. They are a couple regulators-sponosored providers you to purchase mortgages away from loan providers.

Read moreBergen Condition Conforming Mortgage Restrictions having 2018