For 2 years now, the latest Arizona housing marketplace might have been since the sizzling hot because the climate on a good Phoenix summer go out. Whether you are a keen AZ indigenous tired of renting, a family wanting to posting to a bigger lay, otherwise a good snowbird in search of an extra family, this guide will allow you to understand the basics of shopping for a beneficial home from inside the Arizona. Listed below are some inquiries this e-book commonly respond to:

o Precisely what does my personal borrowing connect with myself during the to find a beneficial house?o What is my cover to acquire property?o What’s the average month-to-month mortgage repayment from inside the Washington?o Exactly how much am i going to significance of my personal deposit?o In which is the least expensive house inside Arizona?

With regards to the You.S. Census Agency step one , 65.6% from Us americans was in fact property owners since . Do you want to join their ranks? Make use of this ebook to prepare your self per phase of getting a house in Arizona.

???Added bonus Goods: Install the brand new PDF now to receive 2023’s Top 10 Arizona Zip Rules Housing industry Declaration as well as average home prices for every single postcode, amount of effective postings and much more. ???

Credit rating

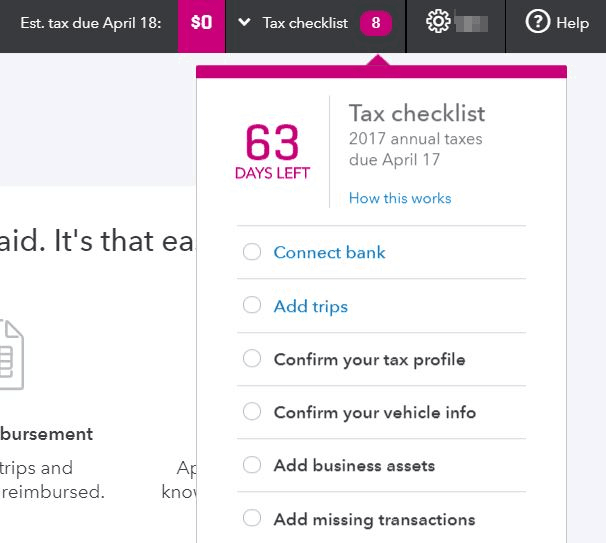

Can be your borrowing from the bank sufficient to score higher financing? Borrowing from the bank Karma reports one to very first time homeowners in the Washington possess an enthusiastic average VantageScore of 719 , upwards nearly fifty affairs over the past 24 months. Copper County Borrowing from the bank Relationship participants has actually totally free the means to access the credit score right from its online financial dashboard.

Read moreWill you be To acquire property into the Washington? We have found Your Ultimate Book