A personal loan to own do-it-yourself is straightforward

How do Home improvement Money Work? After you’ve started approved, the borrowed funds count is put on your family savings, normally contained in this a couple of days. You could potentially invest it as you desire for your house improvements.

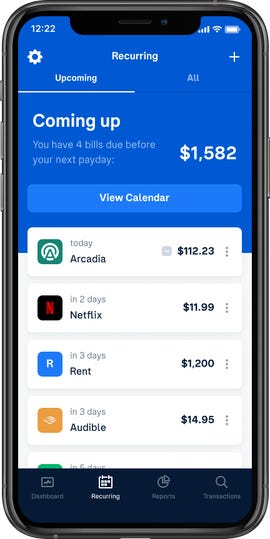

You will then located month-to-month comments. Repayments are typically owed once paydayloancolorado.net/silverthorne/ per month on a single time, over the lifetime of the loan.

You will understand the definition of (amount of the loan) before you invest in it. That have fixed Apr unsecured loans (that is exactly what Old Federal also offers), the payment per month will also be given ahead of your closure the mortgage, and this number will be will still be a comparable throughout the longevity of the borrowed funds. Within circumstances, there needs to be no unexpected situations.

Typically, regardless of if, the reduced your credit rating, the higher your rate of interest

If you are considering a changeable rate consumer loan, or that loan with a good balloon fee, otherwise a changeable speed personal loan, make sure you comment the brand new terms cautiously. The commission amount get change from inside the longevity of the mortgage, so you should definitely understand the information of your agreement.

Can you Rating a house Upgrade Loan with Less than perfect credit?It depends on the condition. Certainly, one may get approved to have a personal loan which have quicker than finest borrowing. Thus, while you could possibly get qualify for a house improvement loan with crappy borrowing, the speed youre provided are unsightly.

Within the a situation like this, you can chat to good banker concerning your options. Particularly, if you have good guarantee in your home, making an application for a good HELOC or Household Guarantee Financing may make more feel. Because these forms of borrowing from the bank is actually secure by your house, loan providers are usually expected to render a lesser rate.

Like most economic equipment, a property improve financing tends to be a great fit for sure affairs rather than because higher a fit for most other points.

Read moreA personal loan to own do-it-yourself is straightforward