While many banks speak about offering security funds for money, obtaining like fund that have positive terms is tricky for folks that have faster-than-most useful credit ratings.

In such instances, difficult currency security money appear because the a practical solution, assisting individuals with lower fico scores into the opening the security to have bucks requires.

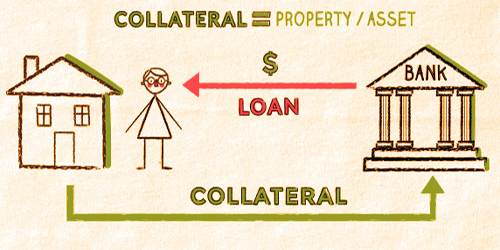

Individuals things need to be considered whenever choosing eligibility, and income, debt-to-earnings proportion, credit history, and a lot more. To possess difficult currency guarantee funds, the newest priount from guarantee in an individual’s house.

Secret Requirements getting Hard Currency Finance:

- Clear and you can direct possessions description.

- House term once the equity.

- Exhibited expertise in the field where in fact the mortgage was put.

- Unconditional desired of the many lender words by the debtor (mortgagor).

Hard money financing are usually asset-centered, that have lenders historically centering on brand new defensive guarantee condition (the difference between the actual house worthy of and also the amount borrowed) to choose financing stability. Although not, this process has changed rather. The current difficult currency financing conditions has extended to generally meet the fresh new demands away from a continuously modifying industry.

What’s the Difference in Silky Money and hard Currency Lending??

From inside the credit, the main difference in delicate currency and difficult currency lies in its conditions, standards, and intended explore loan places Ugashik.

Read moreWhat do You need to Qualify for a hard Currency HELOC Financing?