Kristen Barrett is actually a managing editor within LendEDU. She resides in Cincinnati, Kansas, and also edited and you may composed private financing blogs while the 2015.

Along with its features simply for 23 says, of a lot possible consumers will dsicover by themselves ineligible strictly according to geographical limitations. Stay while the we’re having the information in the Area home collateral, guaranteeing you happen to be well-ready to make the step two on your economic travel.

- How does Area works?

- Qualification

- Cost

- Pros and cons

- FAQ

On the Point

Based when you look at the 2015, Point is designed to build homeownership way more accessible and you will financially flexible. Its purpose will be to render home owners a forward thinking way to tap to their family collateral without monthly money. By offering house security assets (HEIs) rather than conventional https://www.paydayloancolorado.net/eaton loans, Part provides a different financing services.

The organization plans residents looking to economic autonomy as opposed to taking up significantly more financial obligation. If you ought to consolidate higher-notice bills, redesign your residence, otherwise security informative expenses, Area also offers a no-monthly-fee service you to definitely aligns with your residence’s coming well worth.

Why does Point works?

Section offers an excellent nontraditional cure for access your own house’s really worth through its house security resource model. In lieu of old-fashioned household guarantee loans otherwise household collateral personal lines of credit, Point acts as an investor on your possessions, and there are not any monthly installments.

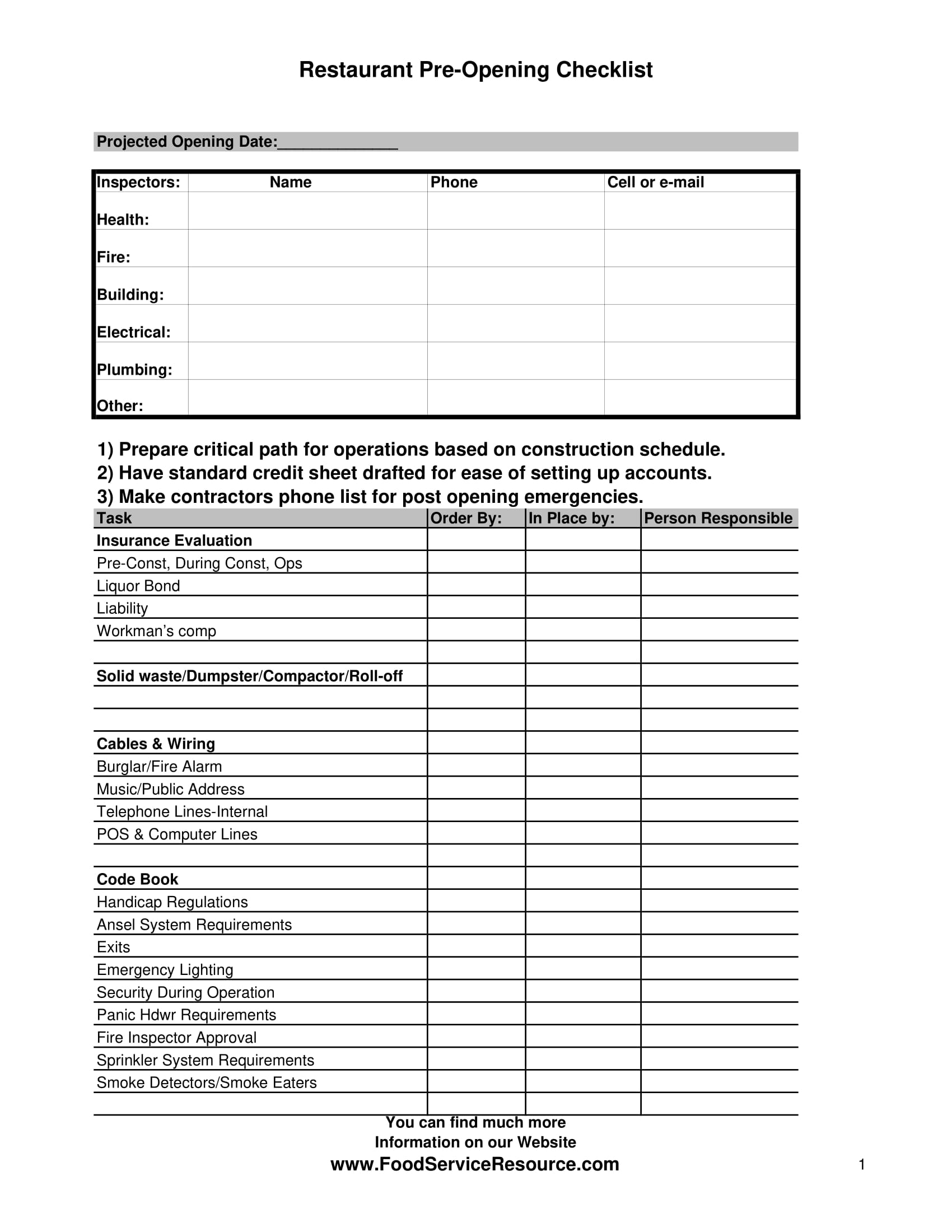

- Mortgage quantity: $twenty five,000 $five-hundred,000

- Title size: 3 decades, no monthly premiums

- Payment choices: Pay-off very early instead penalties

- Book provides: No monthly premiums, zero impact on debt-to-money ratio, no earnings standards

Having Point’s flexible words, you could make yes disregard the matches your financial requires, regardless if you are looking to build significant home improvements or consolidate obligations.