- Locking inside the a good speed

- Overseeing economic trend

- Asking on most programs with your financial

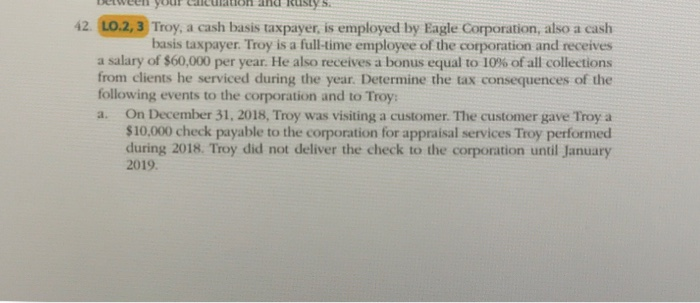

If you are borrowers do not have the exact same quantity of handle as they have with a traditional home loan, you’ll find steps the debtor takes to ensure it snag the best speed and you will terminology centered on her situation.

The first step is by using having an experienced, credible mortgage lender who will help suit your individual financial predicament and you will desires into the correct mortgage alternatives.

We promise to be your ex and you will endorse during every step, ensuring you understand the brand new terms and you may requirements regarding the that it mortgage.

- 62 otherwise earlier

- Home is the main residence

- HUD-approved property designs, like solitary-family relations home, apartments or townhomes

- Done reverse financial counseling off good HUD-accepted counselor

- High collateral of your house

- And additionally one financial-based borrowing, money or resource criteria

Understand that a reverse real estate loan doesn’t feel owed until you escape, offer the house, perish otherwise are not able to keep up with the household otherwise shell out fees and insurance coverage. It is possible to pay off the mortgage anytime for people who very like.

If you feel your qualify for a good HECM, implement now having Compass Home loan otherwise contact us from the (877) 677-0609 to speak so you can that loan manager.

Trick Takeaways

An opposing mortgage is a type of mortgage having property owners aged 62 and you will elderly. It lets you move a portion of the house’s guarantee on the bucks.

Specific conditions must be met to be eligible for a face-to-face financial, plus possessing home and having sufficient security.

An opposing mortgage makes it possible to repay financial obligation and you will alive a whole lot more safely in the retirement. But it is important to score the contract details before signing toward dotted range.

Relevant Topics

If you like extra money to cover medical care will set you back and you will almost every other need during the old age, you may be curious when the an other financial is the address. Taking out fully an other financial is a huge decision. Before you could work, it is very important learn more about exactly what a reverse mortgage are as well as how it functions.

What exactly is a contrary home loan?

An other home loan is a separate type of mortgage having people aged 62 and you can more mature. They lets you move the main collateral on your home towards the dollars without the need to sell or make even more monthly installments. However, in place of a conventional home collateral mortgage otherwise next home loan, you don’t have to repay personal loans online Colorado the mortgage unless you possibly zero offered utilize the household as your number 1 household-or if you neglect to meet the mortgage personal debt.

Reverse mortgages can handle older adults just who currently individual a good family. They have either paid it off entirely otherwise features extreme collateral-no less than fifty% of one’s property’s really worth.

You’ll find different types of opposite mortgage loans with assorted fee actions, but most was Household Equity Sales Mortgage loans (HECM). These financing is actually covered by the Federal Housing Administration (FHA). The FHA maintains strict opposite home loan requirements to assist cover one another individuals and you may loan providers.

Why does a contrary financial works?

A reverse financial try a-twist towards the a classic mortgage, for which you take out financing and you will shell out the lender for each and every week. Which have a reverse financial, you obtain a loan for which you borrow secured on the new equity in your home. There are no monthly dominant and you can attract costs. Rather, the loan is actually turned into monthly premiums to you. It money are able to be used to pay-off personal debt otherwise money important prices-of-bills particularly as well as medical expense. Opposite mortgage loans essentially are not useful for getaways and other “fun” costs.