It is particularly important to know in the event the loan application is approved or disapproved if you have already produced a deposit to help you https://paydayloanalabama.com/brantleyville/ a great assets creator or you don’t want to cure a hot property. Ask how short he is within the handling the job. Some financial institutions make certain as little as 5 days to provide a choice. Usually, it will require a week. Be suspicious out of timely control claims that can indeed capture days unlike weeks, states Bobby.

What you would like is to try to have time to make use of having a separate bank if for example the software becomes disapproved. To take the brand new safe, Alex says that essentially, you will want to submit an application for the mortgage basic and you may safer approval of the financial institution prior to investing any money since no person can to make certain you regarding how long it entails a lender to help you process your loan or if perhaps it does even get approved whatsoever. Specific financial institutions take longer than usual so you can accept that loan while the some issues with brand new title of one’s guarantee possessions.

Anybody else make discounts available or bucks backs because the a limited promo

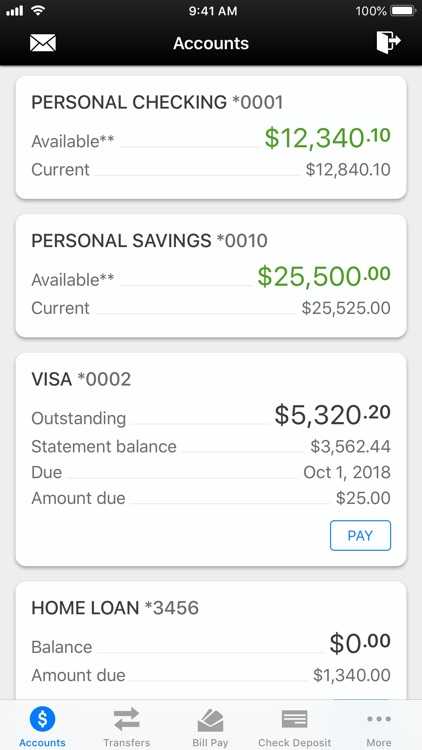

You additionally should make yes it is easy and you will smoother for that shell out the amortization. Query how and you may where you can spend. Particular finance companies high light its wide department system, to pay at any of the twigs. Yet not, very banks enable you to shell out playing with article-dated inspections otherwise explore their automatic debit plan.

The procedure of obtaining financing can really be a demanding experience. You can also work on a bank that will hand-hold your otherwise stick to one that does not hound you if the you will be often later having repayments. Financing officers who happen to be polite, diligent, and you can flexible normally convince your even although you discover a beneficial lower rate someplace else. Particular banks submit and choose right up data from your home otherwise place of work. In addition, you need certainly to song your loan balance and money from the mobile phone an internet-based. Sadly, you do not get to inquire about exactly how the customer service are. Sure, you could query other people. However it is something that you can only experience.

An amortization plan try a dining table describing their periodic mortgage payments

5. How can you calculate my personal amortization agenda? Query the bank when it also provides each other upright-line and you may decreasing-balance alternatives. Having straight-line, your own monthly installments is actually fixed. Having ortization in the first few years however, since your financing balance-the reason behind new monthly desire-refuses regarding the term, your instalments including drop off because you close to the prevent of the identity.

nine. Are you experiencing an existing or next discount I need to understand? Some financial institutions dangle giveaways or a way to subscribe raffles and you can winnings larger honours. Specific waive software and you may appraisal costs. Of many throw in a good pre-accepted mastercard or package a pre-licensed device loan at a favorite speed and you can stretched terminology. There are even promos that can come back your dominant once the end of the borrowed funds label. At this time, some banks commonly lower your rates the greater your put harmony has been them. Usually query what else you can aquire. But don’t get this your main basis. Bobby Disini, vice-president and you may direct of PSBank’s Home loan Banking Division, cautions, End falling to have offres without built-in really worth including quick freebies you to definitely you will need to cover-up exactly what most counts for a loan debtor for example low interest, quick processing, and more reasonable mortgage terms and conditions. 10. Why should I borrow from you? Ok, try not to inquire it bluntly, however need appreciate this are an excellent borrower’s field, just what with so many contending loan providers fighting more your business. Thus people competitive advantage work in your favor.