The home need to be without defective design otherwise rust. Brand new Virtual assistant appraiser have a tendency to research the house or property to own eg points, also proof of any wood-destroying insects. Infestations, eg termites, can cause expensive and you will risky damage to the foundation of a beneficial home.

Lead-built painting

If you’re looking in the residential property oriented in advance of 1978, you will find a high probability this new appraiser often consult color solutions. This is because the appraiser have to think that a house out-of it ages has actually lead-depending painting. Any paint flaws including chipping otherwise peeling need to be repaired, as this is a lead poisoning possibilities.

It is fairly common getting older homes having shorter-than-perfect parts of the exterior or indoor color. Fortunately, this is not an emotional otherwise pricey repair. In case the defective element of decorate is not all that big, a painting specialist can frequently scratch, best, and re also-color the room fairly quickly and you may cheaply.

However, you will find a chance the body in itself keeps deteriorated. In such a case, the new siding or indoor wallboard must be replaced, in addition to the paint. This might attract more high priced.

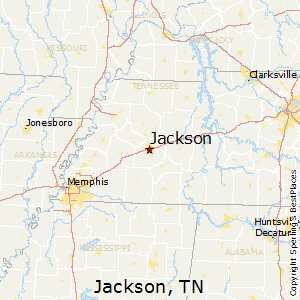

Located area of the family

Taking care of of property you to definitely a veteran may well not consider throughout the before making an offer ‘s the geographic area and you can the surrounding functions. Should your domestic is located on a petrol or oils pipeline easement, it might not eligible for Virtual assistant funding. The new easement ‘s the city encompassing the newest pipe, a boundary getting energy crews to gain access to and you will work at brand new pipeline.

Whether your domestic design is situated in this 220 m on sometimes side of the tube (the fresh tube alone, maybe not the newest easement), a page must be compiled by the latest pipeline team saying that the new pipe are certified that have certain codes.

On the other hand, there are limits resistant to the family are as well near to high-voltage digital lines. The dwelling otherwise outbuildings is almost certainly Freeport loans not from inside the digital line easement (barrier city). That it rule does not consider fundamental path strength contours, however, large, high-current sign lines.

Are manufactured house

Are manufactured house must meet the practical MPRs away from basic land, with some more standards. The house must be forever connected so you can a charity that’s adequate for the stream of the property. Simultaneously, manufactured residential property in some geographic metropolitan areas might need unique ties and you can bindings to withstand hurricanes and you will earthquakes.

Very are built property requires permanent skirting, which is an ongoing metal or wood enclosure inside the basis. At the same time, really are produced property you desire a steam hindrance, that is merely a continuing vinyl level along side launched planet or dirt from the spider room.

Whom pays for solutions?

If the solutions are expected, such as for example decorate resolve, roof fix, an such like., it is best whether your provider helps make the fixes on his otherwise her very own pricing in advance of closing. If your seller has no money to accomplish the latest repairs, probably the realtors inside it can find an effective way to result in the fixes. If you have no chance doing new fixes, and are generally needed to see Va capital, you might have to back from the offer and acquire a far greater house.

This is not a good option towards experienced to cover solutions out of their own pouch just before closure. Say, as an instance, you only pay $5000 inside the fixes, and then your loan was denied in some way. You merely spent tons of money renovating another person’s home.

Neither is it better to take on guarantees regarding the provider to help you build solutions immediately following closure. For one, the lender doesn’t romantic the loan when your home keeps Va inadequacies. Next, the bets is actually away from given that mortgage shuts. The seller won’t have people desire to make the solutions from the that point.