If you’re birth your way of shopping for very first domestic, it is critical to have an understanding of employment conditions to be eligible for home financing. We wish to be sure to getting pretty sure and you may told, very let’s dive towards principles out-of what it takes so you’re able to safer a home loan, whether it’s a basic FHA mortgage or you to definitely as a result of TruePath Home loan.

Stable A job

In order to be eligible for a mortgage, lenders generally get a hold of steady a position. It indicates having a constant income source one ensures all of them your can make their monthly premiums. Most loan providers discover proof a-two-12 months works records. Conditions can vary while you are care about-employed otherwise a small business manager.

Earnings Verification

Lenders will also consult proof of your revenue. This consists of recent shell out stubs, tax returns, or a career confirmation characters. It is all regarding the indicating that you have the fresh methods to pay back the loan and keep maintaining your new domestic.

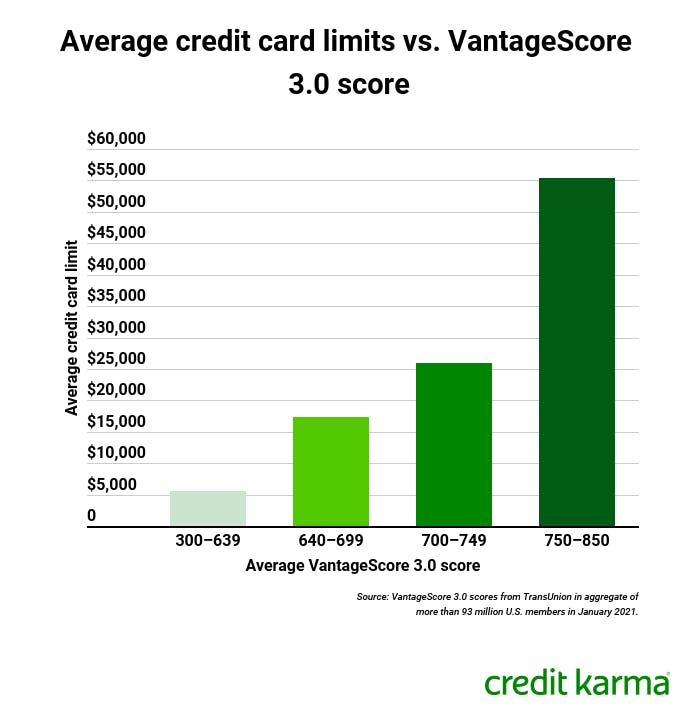

Credit history

Whilst not actually tied to employment, your credit score is a significant reason behind mortgage approval. Spending debts timely and you may dealing with expense sensibly subscribe to a great positive credit history, to make loan providers well informed in your capacity to manage a home loan.

Wisdom FHA Conditions: Minimal Credit ratings & Off Costs

For these given an elementary FHA financing, listed below are some additional factors to remember. FHA fund normally have so much more easy credit score standards compared to the traditional mortgage loans.

FHA finance typically want a lowered downpayment, and also make homeownership far more accessible. FHA fund allow individuals with a credit history away from 580 or highest to acquire a home with an advance payment as the low since the 3.5% of your own cost. For these having credit ratings between five hundred so you’re able to 579, a minimum down-payment from ten% must secure the financing. The newest deposit matter can vary considering your credit rating and other items, it is therefore important to talk about that it together with your financial advisor.

Wisdom TruePath Financial

TruePath Financial, crafted by Dual Towns and cities Environment to have Humankind, offers a different chance for first-big date homebuyers. These types of apps consider carefully your specific finances that will were down payment guidance or beneficial interest rates.

So you’re able to qualify for TruePath, it is far better to has actually a credit score of at least 620. Yet not, in the event your score falls anywhere between 580 and you will 620 or if you lack a credit history, you can still implement by giving choice borrowing documents. You want as much as $6,3 hundred within the savings and make certain that your particular full monthly financial obligation payments dont meet or exceed 13% of your own disgusting month-to-month earnings. One outstanding collections will be simply for all in all, $step one,000, or $step three,000 when they scientific selections.

To own work, you’ll need to have been in your existing job for from the the very least half a year, which have an ongoing several-seasons a job background getting full-go out efforts. Whenever you are region-day or notice-operating, you should have been on the newest condition for around 24 months Sunrise loans online.

Which have a fixed interest less than other situations to the the marketplace, TruePath even offers balance more a thirty-season title. Your month-to-month casing fee is made to end up being sensible, set during the no more than 29% of gross income. The good thing? You certainly do not need to own financial insurance coverage. You could secure doing 96.5% of your home’s well worth through this mortgage, that have options for down-payment and you may affordability recommendations centered on your own income and you may qualifications.

Habitat to have Mankind is actually committed to your success. TruePath Mortgage offers economic degree programmes, ensuring you become confident and you will told about dealing with their financial and you can home expenditures. Whether you are investigating a standard FHA financing or TruePath Home loan because of the Environment, understand that Twin Locations Environment for Humankind is here now to help with your. We think in your imagine homeownership, and you will we are intent on making it a real possibility. When you yourself have any queries, all of us is able to show you each step of method. Thanks for visiting the road out of homeownership!