The fresh Government Homes Money Institution (FHFA) is actually an effective You.S. bodies service developed by brand new Homes and Monetary Data recovery Act out-of 2008 (HERA). Their fundamental role is to try to bring supervision out-of mortgage and you will homes credit regulators-backed businesses (GSEs), specifically the brand new Fannie mae (Federal national mortgage association), Government Financial Home loan Enterprise (Freddie Mac), as well as the Government Financial Banking system.

Tips

- The fresh FHFA is actually charged with making sure its managed agencies operate soundly to aid maintain exchangeability regarding home loan industry.

- After the business of your FHFA, Fannie mae and you may Freddie Mac computer were placed into conservatorship on goal of returning them to solvency.

- Area of the FHFA’s funds goes to enabling low-income household obtain reasonable homes.

Whenever are the latest FHFA founded and exactly why?

The Government Construction Finance Agency was created in 2008 on the wake of your own 200708 overall economy. Especially, it absolutely was designed to address default-associated monetary strain from the Federal national mortgage association and you can Freddie Mac-hence, since government-paid businesses (GSEs), was in fact in public places stored organizations, but with a good tacit government backing. In the event that a couple GSEs required good bailout in order to stay afloat (and this critics argued try due at the very least partly to lax financing conditions), policymakers concluded that the best way forward will be enhanced oversight thanks to a unique institution.

Even when one another GSEs is actually commercially belonging to shareholders, by 2024, both are nonetheless underneath the conservatorship of your FHFA. Fannie mae offers trading into U.S. exchanges under the ticker symbol FNMA; Freddie Mac offers are still for the delisted condition.

Along with Federal national mortgage association and you will Freddie Mac computer, the new FHFA is additionally guilty of the 11 Federal Home loan Banks (FHLBanks) and you can Office out of Finance. Of the managing this type of entities, the brand new FHFA tries to make sure the homes finance sector remains stable and can operate in some economic conditions. The new FHFA is in charge of supervising more $8 trillion into the financial capital along side Us.

FHFA takeover away from Federal national mortgage association and you will Freddie Mac

Fannie and you will Freddie is tasked by the government to help maintain liquidity in the mortgage business. They do this mainly by buying mortgages toward secondary market, packaging many of them to your mortgage-backed securities (MBS)-fundamentally pools visit the link out of mortgages-and you can selling these to traders. Financial securitization frees up loan providers and work out a whole lot more home loans once the they are able to offload the danger to those happy to bear they.

Immediately after it absolutely was established, the fresh new FHFA put Fannie and you can Freddie on conservatorship. The 2 GSEs were towards the verge off failure given that defaults about 2007 home loan market meltdown been pulling to their equilibrium sheet sets. The recently founded FHFA establish for nearly $200 mil inside the bailout money from brand new U.S. Treasury.

At the same time, this new FHFA changed brand new chatrooms out-of directors to possess Fannie and you may Freddie and you can first started applying the brand new principles built to cure working risk. Throughout the years, the two GSEs paid their funds. From the 2019, they first started sustaining its earnings and you can creating financing supplies. Even though they can efforts with a little way more freedom, Fannie and you can Freddie remain not as much as conservatorship as of 2024.

Core characteristics of one’s FHFA

To steadfastly keep up exchangeability throughout the construction fund business, the fresh new FHFA was designed to make certain that government-paid entities was solvent. Check out ways by which this new FHFA meets its objective:

- Look at for every FHLBank a-year so surgery is actually voice and you can banking institutions are solvent.

- Monitor financial obligation provided from the Place of work out of Finance.

- Frequently remark brand new functions regarding Federal national mortgage association and you may Freddie Mac in order to ensure they continue to be solvent and you can sound.

- Maintain conservatorship more Fannie and you may Freddie in addition to their assets.

- Song economic field styles and you can highly recommend improvements and you can courses regarding step so you can regulated agencies.

- Strongly recommend code evaluations to make guidelines from the costs and you can means place in place from the GSEs and FHLBanks.

Just how is the FHFA financed?

This new Government Houses Money Agencies will not located the budget away from Congress. Instead, capital is inspired by controlled organizations (just like the means the fresh FDIC try funded of the representative finance companies). Basically, Fannie, Freddie, therefore the FHLBanks take a portion of the costs and rehearse that money to pay for the fresh FHFA.

The fresh new FHFA is another department

It is critical to keep in mind that the newest Federal Construction Money Service is actually separate in the Federal Property Government (FHA). The two are very different agencies and you will discover its funding away from more sources.

A portion of the finances goes to enabling low-money family members see sensible housing through the national Houses Trust Financing. The capital Magnetic Financing supports society creativity programs. New FHFA facilitate manage these types of financing and facilitates the new GSEs’ contributions to these effort. When you look at the 2024, Fannie and you will Freddie shared $301 mil earmarked of these two money.

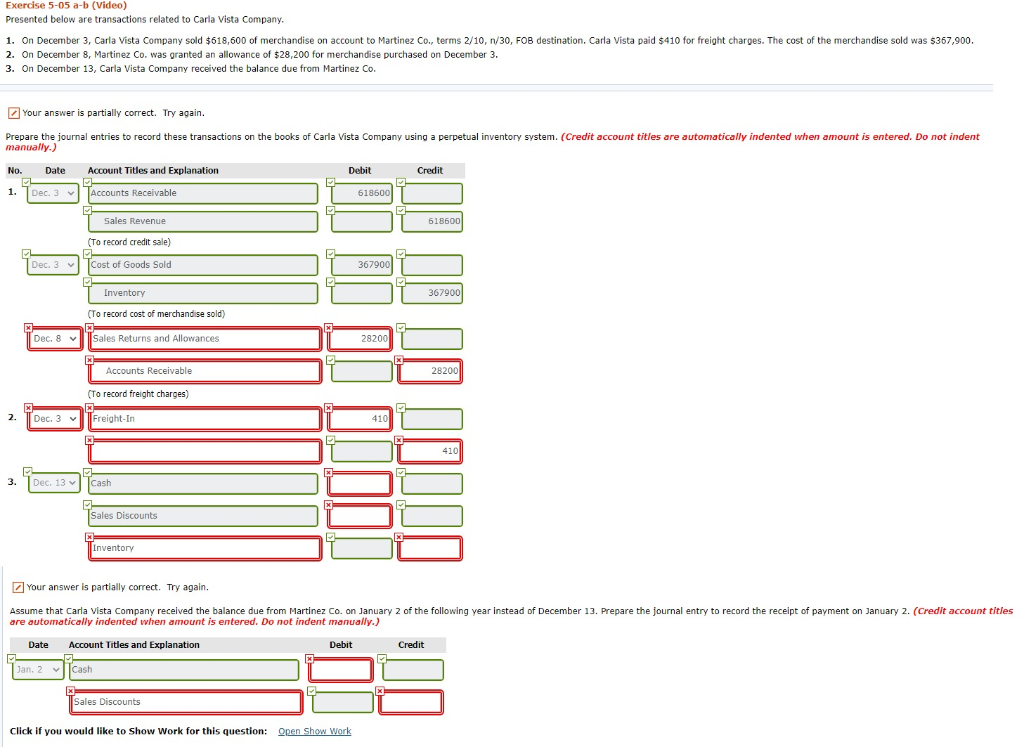

One of the ways the federal government decrease its chance whenever issuing otherwise providing over mortgages is via billing loan-height price changes (LLPAs). These costs, which can be gathered into the what is called the LLPA Matrix, are derived from the following affairs:

In 2023, the FHFA recommended the brand new costs according to DTI. Mortgage community leadership said the latest timeline is unworkable therefore the charges do demand an unrealistic burden into individuals, in addition to rule was rescinded from the FHFA.

A different conflict inside the 2023 stemmed out of a great rumor one to the fresh laws carry out trigger people who have large credit scores expenses even more inside the charges than others which have straight down credit scores. It was refuted by FHFA director Sandra L. Thompson.

In the long run, this new FHFA revamped the statutes and you may took type in into consideration just before starting brand new LLPA matrix to possess 2024.

The bottom line

This new Federal Property Fund Company was created to provide an additional quantity of oversight that was sensed as lost top upwards with the financial crisis regarding 200708. From the managing and you can evaluating the soundness off Federal national mortgage association, Freddie Mac, therefore the Federal Financial Banking institutions, the brand new FHFA try assigned with making certain that the loan field stays liquid and that the federal government should not need to use a unique massive bailout subsequently.