Rising prices keeps triggered a significant escalation in credit card stability because the people face large charges for products or services. As cost of living goes up, anybody often check out playing cards to pay for informal expenditures, resulting in increased borrowing. It reliance on borrowing from the bank are compounded by the wages that may maybe not carry on with that have rising cost of living, forcing of numerous to utilize handmade cards to help you connection the newest gap ranging from their money and you may expenses. Additionally, high interest levels which are a routine a reaction to rising cost of living by the main finance companies, allow it to be more expensive to take an equilibrium into the handmade cards.

So it blend of rising prices loans in Goldville and better interest levels creates a good period in which personal credit card debt increases, therefore it is much harder to have customers to repay its balance and you may probably causing deeper financial filters. If you’ve located yourself in cases like this, it’s not just you. On this page, we’re going to speak about broadening credit card stability, delinquencies, rates, and you can whether or not you really need to combine your debts with the a home loan In advance of you will be making a late commission.

Bank card Delinquencies

High stability and large interest rates try making specific group inside a situation in which they may be facing missed money. With respect to the New york Government Reserve, bank card delinquencies is around 8.90%. As well, the utilization rate keeps a powerful impact on riding delinquency.

When you’re borrowers who have been current into the all their notes on the very first quarter from 2024 got an average application price from 13 percent in the earlier quarter, individuals who turned into recently delinquent got an average rate of 90 %.

These types of charts and you will amounts let us know that the highest the total amount you’ve got used of your own credit card balance, the greater youre vulnerable to as delinquent. While bringing maxed from your cards, then it is time and energy to do something positive about it Before you can miss an installment.

For anyone carrying an equilibrium on the handmade cards, specifically nearing its maximum, the latest feeling of 1 late fee more than 1 month you certainly will miss its credit history by just as much as 100 activities. This will impression their capability in order to secure upcoming money.

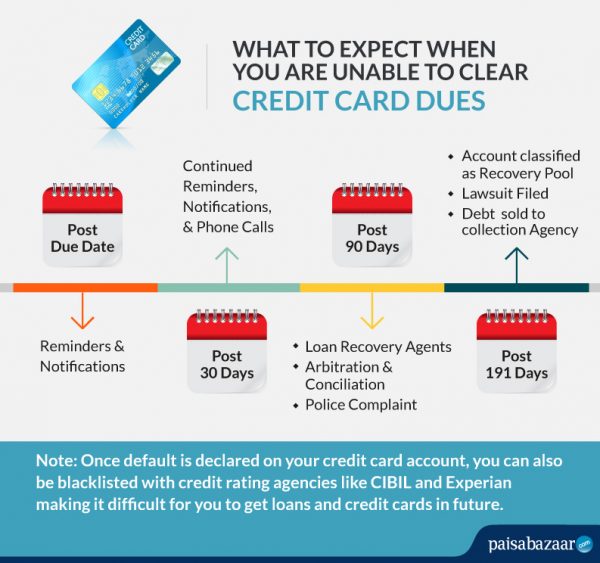

Destroyed a repayment toward a credit membership may have significant unfavorable outcomes in your credit history. Payment history the most essential facts from inside the figuring your credit rating, bookkeeping for approximately thirty five% of full get in the most common credit reporting activities. A missed commission, whether or not it’s just a short time late, would be stated in order to credit agencies and become on your own borrowing statement for approximately eight many years.

This can lead to a substantial lose on your credit score, making it more difficult locate the fresh credit or safe favorable rates. In addition, an overlooked fee can produce later charge and better rates to the current balances, next exacerbating monetary filter systems. Repeatedly shed costs may cause more severe consequences, eg defaulting towards the funds, that may severely damage your own creditworthiness and you may curb your economic options in the future.

Exactly how House Collateral Resource Assists

With mastercard rates of interest more 27%, the key to saving cash is swinging stability so you’re able to an alternative having a diminished rate of interest. Given that a property obtains the mortgage, the pace is a lot less than compared to handmade cards, that are unsecured. Rates of interest to own household collateral fund cover anything from eight% so you’re able to twelve% in today’s market, which is far lower compared to 27% individuals is actually discussing today.

I grab a deep plunge on quantity, however it is important to consider the enough time-term will set you back out of lowest payments into charge card stability and more funds you pay through the years.

A first financial ‘s the first loan received to shop for a great house, safeguarded by the property in itself. It has got priority more than almost every other liens otherwise says to the assets. The fresh new regards to a primary mortgage usually include a fixed or varying interest and you will a fees several months between 15 to help you thirty years. Conversely, one minute mortgage, called a property equity financing otherwise line of credit, is another mortgage applied for up against the guarantee on your own household, which is the difference between the brand new house’s current market worth and the remaining harmony on the first-mortgage.

Next mortgage loans will often have large rates than first mortgage loans since the they are using. If for example the debtor non-payments, next mortgage lender is just repaid after the first-mortgage bank was satisfied. Despite the greater risk, second mortgages shall be a helpful financial tool getting being able to access high finance having biggest expenses like renovations, knowledge, otherwise debt consolidation.

If you have a financial rates on your own earliest loan, a second may be a better choice for you. Anyway, eliminating credit debt gurus somebody who was approaching are maxed away. Refinancing could save you currency, freeing right up extra cash on the month-to-month finances if you find yourself assisting you to avoid the threat of missing money and you may injuring your credit rating.

To summarize

The amounts show that more and more people get closer to using to make difficult economic behavior regarding their obligations. A very important thing accomplish would be to look at the possibilities before you have to build an arduous solutions which will notably affect your financial coming.

Refinancing to a primary otherwise next mortgage are going to be a proper proceed to stop delinquency and you can spend less. From the refinancing, you can also secure a reduced rate of interest, that will lower your month-to-month mortgage repayments, leading them to way more in balance. This can be particularly helpful if you have viewed an increase in your income otherwise a fancy on the residence’s worth as you grabbed your fresh home loan. Additionally, refinancing makes it possible for one combine high-notice costs, particularly credit card stability, to your one, lower-notice mortgage.

That it besides simplifies your financial personal debt but also decreases the complete appeal you pay, freeing upwards earnings and you may assisting you to stay current in your repayments. Refinancing is a valuable unit to avoid delinquency and achieving long-title economic fitness of the decreasing monthly expenses and improving economic balance. Inform us the way we helps you Just before a belated percentage drives your credit score too reduced to qualify.