For more than twenty two ages my party and i also possess lead lowest FHA financial cost inside California plus quick closings and business-leading customer support. All of our FHA mortgage software can be used for both refinance and you will purchase transactions. Our very own client-first method to the new FHA loan techniques form we will tune in earliest following select remedies for meet your home mortgage requires. Contact me now to own a zero-cost/no-duty quote to discover exactly why are you various other.

In other words; it is an insurance policy you have to pay each month that covers a good lender’s loss for those who default on your FHA financing. Find out more throughout the MI here.

The fresh FHA has an optimum amount borrowed that it’ll ensure, that is known as the FHA lending limit. This type of loan constraints was computed and you can current a-year and therefore are swayed because of the traditional financing restrictions set of the Fannie mae and Freddie Mac computer. The kind of family, like solitary-nearest and dearest otherwise duplex, may apply to this type of wide variety.

You can easily note that very Ca counties keeps an enthusiastic FHA Mortgage https://www.paydayloanalabama.com/pinson/ Maximum out-of 420,680 to have an individual-house. Higher-charged aspects of Ca such as for instance Almeda, Contra Costa, La, Marin, Lime, San Benito, San francisco bay area, San Mateo, Santa Clara, and Santa Cruz Condition all possess loan limits of 1,149,825 to own an individual-house. Simply because more expensive homes where town. Other counties fall someplace in between these floor and you will ceiling numbers.

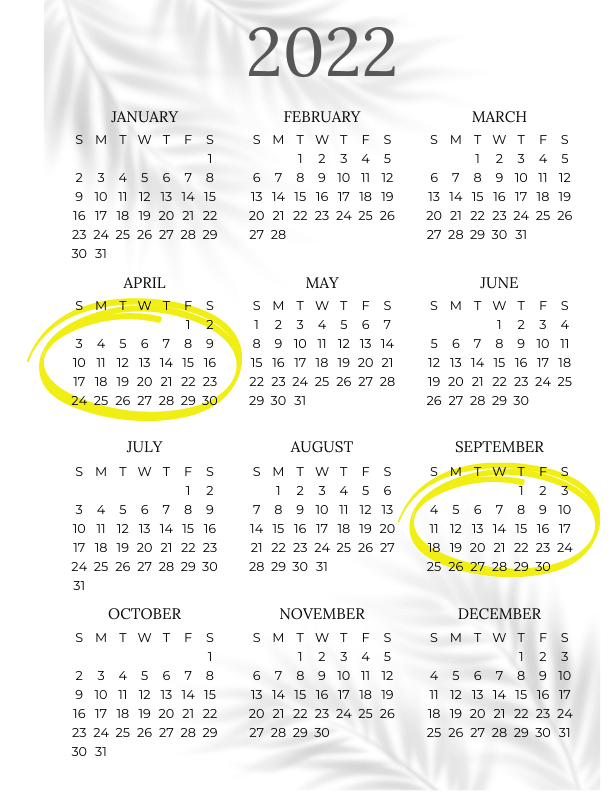

The desk less than has got the 2022 FHA Loan restrictions for everyone counties in California, listed in alphabetical purchase. Within this table, step one product identifies one-family home, 2 product refers to a good duplex-design home with two independent owners, etc.

Concept of a keen FHA Home loan

An enthusiastic FHA financial are a mortgage that is shielded from the authorities, especially new Federal Houses Management. Generally, this is why in the event the a debtor quits purchasing and you can loses its home in a property foreclosure, government entities will make sure the lender cannot experience one losses. You don’t actually get home loan away from FHA; you should have fun with a keen FHA-accredited financial. As all the lenders need certainly to originate their FHA money according to the same key guidance, it is important to evaluate your mortgage options when providing an FHA loan.

Benefits of an enthusiastic FHA Home loan

FHA mortgages have many pros that may extremely result in the distinction getting very first-time home buyers or people which have quicker-than-finest borrowing from the bank. A number of the great things about an enthusiastic FHA financial include the after the:

Low-down Commission

FHA mortgage loans want as low as step three.5 percent down. This is certainly among the low down repayments of every loan device available today. Traditional activities normally want ranging from 10 and you may 20% down, so this is a massive advantage to people who have a tiny less overall in the bank.

Better to Qualify

The complete reason government entities started new FHA program would be to help stretch mortgage loans so you’re able to borrowers during and after the nice Anxiety. FHA has actually proceeded their history regarding placing homeownership in this alot more man’s reach insurance firms larger home loan direction.

Assumable

One to book function away from FHA mortgages is they try assumable. Thus anyone may assume your home mortgage after you offer, whenever they qualify naturally. This is exactly a large work for whenever interest levels rise, due to the fact low interest rate of your own FHA mortgage will likely be thought by the home’s the brand new customers.

Co-Candidate and you can Gift Funds

Of these wanting some extra push to begin with, and those with friends gifting all of them money, FHA allows for one another co-candidates and you may provide financing. Co-applicants indeed be eligible for and are accountable for the mortgage with you. Because there is zero requirements concerning who indeed pays the home loan, it ought to be reduced for the-date monthly, or you will each other be kept accountable. Current financing can be used for a percentage or all of the downpayment for your FHA mortgage.