What is swing trading

We tested 17 online trading platforms for this guide. What are Penny Stocks. Measure content performance. The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. Algorithmic algo traders use automated systems that analyse chart patterns then open and close positions on their behalf. Consider your markets too. While traditional brokerage firms in India provide a range of beneficial services, potential investors should carefully consider whether the higher costs are justified by the personalised service and professional guidance they receive. A per share commission pricing structure is beneficial to scalpers, especially for those who tend to scale smaller pieces in and out of positions. Correct predictions double your investment. Other features include.

How to Download the Colour Trading App

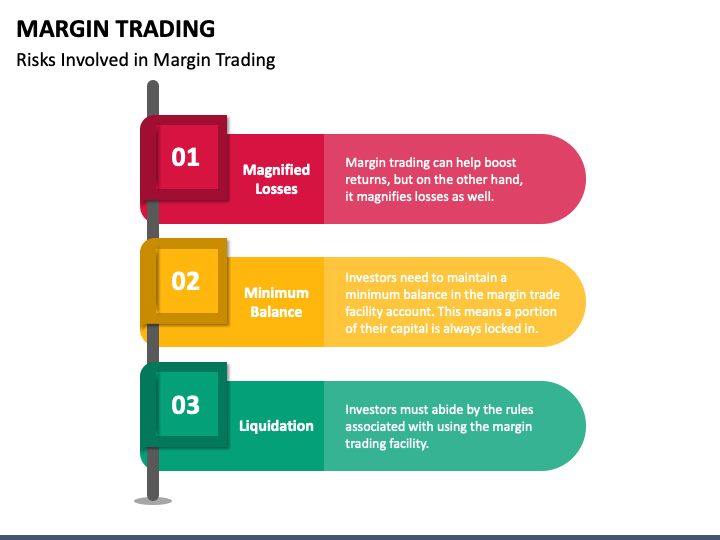

Even if you have the best trading strategy, ample capital, and all the confidence in the world, it’s not necessarily enough. People trade stocks for one reason: to make money. Intraday trading can be more profitable for those who can accurately predict short term price movements and capitalize on daily market fluctuations. When used for investing, margin can magnify your profits—and your losses. Platform where traders earn more. Market participants are institutions, investment banks, commercial banks, and retail investors worldwide. Recently, investing in Brazil has meant attempting to profit from a downturn as Brazilian stocks have struggled amid economic and political turmoil. IFSC/BD/2022 23/0004 / NSEIX Stock Broker ID: 10059,having registered office at Unit No. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. Use your favorite technical analysis tools on the markets you want to trade and decide what your first trade should be. This trend line can show whether the value of an asset is increasing bullish or decreasing bearish. Learn how to create a plan that will help you achieve your trading goals, and discover tools you can use to manage risk. If the client wishes https://pocketoptionon.top/vt/about-us/ to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. This policy is designed to protect investors from trading beyond their abilities or financial means and to protect brokerage firms against potential defaults on margin accounts. How does margin work in futures trading. Amazing investment portfolio selection. The Fibonacci retracement is a common tool, used to confirm whether the market surpasses known retracement levels. Stock trading is a difficult and risky enterprise, but with education, you can work to lower risks and increase your likelihood of success. Probably because they are overexposed or staking 10 percent of their account in one go. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. I agree to terms and conditions. 05, the price can move from INR 10. Sure, tips and tricks are helpful—but here are some tangible steps you can take if you’re eager to dip your toes into the world of stock trading. Traders apply this pattern in several trading options: technical analysis, figuring/defining trading strategy, identifying security movement, and identifying recurring patterns.

2 Step

However, if you are right and the stock drops to $45, you would make $3 $50 minus $45, less the $2 premium. Stops and limits are highly recommended tools for managing your risk while trading futures. F Depreciation and amortization expenses. Guide to diagram:A – Trade entry pointB – Stop lossC – Price forecast exit levelD – Fibonacci technical analysis. List of Partners vendors. This came after Goenka proposed to the Securities and Exchange Board of India Sebi to settle the proceedings “without admitting or denying the findings” through a settlement order. Then, do your own calculations to determine which exchange actually has the lowest fees. To Profit and Loss A/c. To rank each mobile trading platform, I assessed over a dozen individual variables, and all testing was conducted using both a Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra device running Android OS 12. When a stock is in a downtrend, the RSI will typically hold below 70 and frequently reach 30 or below. The transaction isn’t considered final until it has been verified and added to the blockchain through a process called mining. No need to issue cheques by investors while subscribing to IPO. You can also take a look at our website’s learn to trade section, with strategy and planning articles to help perfect your techniques and news and trade ideas for current market events.

Step 2 of 3

She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position. Mental fortitude is required in every trader’s field to bounce back from the inevitable setbacks and lousy trading days. Charts in the SaxoTraderGO mobile app sync with the browser based version of the platform. FYERS is one of the best trading platforms in India. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. So I went to visit their office and to learn more about the course. These patterns indicate a period of consolidation where the price is making lower highs and higher lows, showing a decrease in volatility. A margin account may have positions both long and short. Veering into overconfidence can lead to dangerous outcomes. A downside breakout indicates the downtrend will resume. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. You don’t have access to this with spread bets and CFDs. Their team is very responsive and helpful. INR 0 brokerage for life. Aside from the price movement, investors can also gain from time and volatility movements. An option contract in US markets usually represents 100 shares of the underlying security. With competitive and transparent pricing, reasonable spreads, direct trading from the charts, and a practice demo account, the platforms have a lot to offer for active forex traders. They are run by investment fund managers, and more suited to hands off investors. No trader wins on every trade, and even though you might have picked them because they have positive results overall, the provider you choose to copy might go through a period of drawdown – meaning that you would be facing losing positions. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. Join our 2 Cr+ happy customers. Weekly Market Insights 12 July.

Do you have any children under 18?

Traders who engage in these strategies must have a solid understanding of market trends, technical analysis, and risk management techniques to succeed. Get ahead of the learning curve, with knowledge delivered straight to your inbox. If you want to become a consistently successful trader, you need to understand that you are in the business of managing risk vs. Your capital is at risk. Are they a member of SIPC. The volume interval will relate to shares when applied to stocks or exchange traded funds ETFs, contracts when applied to the futures/commodities markets, and lot sizes when used with forex. UK investment apps require a variety of information to open your account. The effects of market fundamentals can be slow to emerge. Apple and the Apple logo are trademarks of Apple Inc, registered in the US and other countries and regions. Currently, fees on the free Kraken Pro platform range from 0% 0. Whilst economic data and other global news events are the catalysts for price movement in a market, we don’t need to analyze them to trade the market successfully. This combination mimics the behavior of a traditional put option, providing investors with an opportunity to profit from downward price movements. Step 6: You’re all set. In this rapidly changing investment landscape, staying updated is crucial. Author: Ashwani Gujral.

Options by Underlying Asset

Optimization is performed in order to determine the most optimal inputs. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. Often, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. When choosing a new forex broker account for online trading, consider these five areas of the trading experience. A trading platform, or a stock trading platform, is simply a place to buy and sell trade investments. Now that almost all stock apps offer free stock trading, we recommend comparing other features to choose the best stock trading app. For example, a bullish chart pattern signals that it’s a good time to buy a particular asset, while a bearish chart pattern indicates that it’s time to sell or take a short position. FastWin’s referral program works on three levels. Chart dating back to 16 September, 2022. Brokers have the power to demand that customers increase the amount of capital they have in the account at any time. To start trading on leverage, it is advisable that a trader starts with a leverage that is lower than their maximum leverage allowance. First, make sure your broker is covered by SIPC protection, which insures the cash and securities in your account in the event of a broker’s failure. Some brokerage firms may offer fixed brokerage charges per trade, while others may have a tiered structure based on the trade value or turnover. It’s low cost, easy to use, and a huge range of investment options. All websites and web based platforms are tested using the latest version https://pocketoptionon.top/ of the Google Chrome browser. These cookies are used for various purposes. In addition to predictive models, investors can use AI technologies to produce risk models. It’s also important to regularly review and assess your portfolio to ensure it aligns with your trading goals and risk tolerance. So if you’re new to currency trading, you could feel better prepared and eased into managing not just trades but risk with more confidence, rather than rushing into dangerous leverages that can lose you money fast.

What is proprietary trading and how does it work?

Research and choose an investment app: When researching the various investment apps that are available, consider factors like the user interface, fees, available investment options, investing tools, and customer service. Based on the internal process and cut off timelines of the Clearing Corporation the funds will be released to the Stock Broker. Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. Figures for the previous reporting period. For complaints, send email on. You’ll want a reputable broker that caters to day traders and has low transaction fees, quick order execution, and a reliable trading platform. IG is a leader in education, making its IG Trading mobile app the best forex trading app for beginners in 2024. At the core of Acorns’ strategy is its Round Ups feature, which enables users to automatically invest their “spare change” with every debit or credit card purchase. It’s one of the cheapest platforms out there, completely commission free, and the lowest fees when buying foreign stocks currency conversion fee. Notably, the TV sets don’t need to be extremely expensive. Plus500 is a trademark of Plus500 Ltd. This is called ‘margin’. If you sell a currency, you are buying another, and if you buy a currency you are selling another.

Trending on The Hindu

Whether trading or investing, here are some important tips to keep you from blowing up your portfolio. We have not established any official presence on Line messaging platform. This is where swing traders see their opportunity – they can get in at the bottom of that dip and ride it back up for a few days, or even a few weeks before it dips again. Brokerage account: Robinhood Financial commission free investing. Interests are brought together by forming a contract and the execution takes place under the system’s rules or by means of the system’s protocols or internal operating procedures. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. One of the main advantages of trend trading is that it helps traders take advantage of current trends rather than trying to predict future movements. One of the key benefits of Acorns for beginners is its simplicity. Then, depending on the digital currency you deposit and the length of time you keep the coins locked away, you could earn up to 12% in interest per year. The Double Bottom Pattern indicates a bearish to bullish trend reversal. Options trading is the buying and selling of options. Please note that this website is intended for individuals residing in jurisdictions where accessing it is permitted by law. Position traders ignore short term price movements and prefer to rely on more precise fundamental analysis and long term trends. This might include BTC/ETH or XRP/ETH. With high leverage margin trading borrowed money and the ability to trade both price directions so shorting too. Key sectors driving growth were manufacturing, up 4. In the past paragraphs we presented you the advantages of the x ticks view by comparing it to the classical time based view. It depends on the individual, and beginners should approach Forex trading with the same mindset as choosing a high skilled profession, like an engineer, a software developer, a lawyer, or a doctor. In order to keep from getting overwhelmed, we created a cheat sheet for you of the most popular candlestick patterns. Many who trade the Forex market risk too much, trade too often and don’t do enough homework before putting money at risk. 9 Tax laws are subject to change and depend on individual circumstances. We’re building a community here. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Financial markets typically have three prevailing long term trends: the bear market, the bull market, or somewhere in between. If FI does not consent to delaying the disclosure, the issuer shall disclose the inside information immediately. To develop a robust trading mindset, it takes time and a certain level of patience to learn from successes and mistakes. One tick is equal to one price fluctuation. SEBI Registration No.

Financial Products

Note, however, that you can”t invest in fractional shares through Merrill Edge® Self Directed. The article on TradingView is the opinion of Optimus Futures, LLC. Traders buy and sell more frequently, while investors typically buy and hold for the long term. However, its fees can be on the higher side compared to some of its competitors. View the backtest results for this strategy. Generally, brokerage fees on intraday trading stocks are one tenth of what is levied if standard trading is undertaken. Market timers attempt to predict the direction of broader market trends and cycles, timing their entry and exit points to capitalize on anticipated market movements. Trading stocks can bring quick gains for those who time the market correctly, but most people, even professional investors fail to do that the majority of the time. Strike Price Exercise PriceThe strike price, or exercise price, is the price per share at which the underlying security may be purchased in the case of a call or sold in the case of a put by the option holder upon exercise of the contract. Com has all data verified by industry participants, it can vary from time to time. Discount stockbrokers like Bajaj Broking offer a flat fee per trade which can help you save the cost considerably. Here’s how to identify the Three Outside Down candlestick pattern. ETF options include ones from iShares and Vanguard, both known for their low expense ratios. Brokers often have lower fees than exchanges, but they may not have as wide a range of cryptocurrencies available. Tradetron’s paper trading is a feature that allows users to simulate their algorithmic trading strategies without risking real capital.

IPO

Where can I learn more about the markets to trade. Picking the correct assets is critical as well with swing trading. This guide will explore the fundamental aspects of the bond market versus the stock market, detail the differences between stocks, shares, and bonds. With the advent of mobile apps and user friendly trading platforms, traders now have access to real time data, research reports, and various tools that assist in making informed decisions. Many state and federal governments are still figuring out how exactly they want to treat cryptocurrencies from a legal and tax standpoint. The user friendly mobile app allows beginners to manage accounts, monitor investments, and access real time market data on the move. ₹0 brokerage on stock investments and flat ₹0 AMC for first year. Here’s a closer look at each one. Improving your trading psychology is an ongoing process that requires self reflection, discipline, and a commitment to continuous learning. Similar to eToro, Plus500 offers a demo account, allowing beginners to practice trading without risking real money. The bottom line is, the trend is your friend. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. When the current market price is above the average price, the market price is expected to fall. When there is no specific trend that can be identified, investors trade using a range trading strategy. A hammer candlestick pattern is a single candlestick pattern that suggests a potential reversal of the overall bullish trend.